November AI App Market: "Light AI Tools" Drive New Growth; "General AI Assistants" Show Strong Retention

After a year of rapid expansion, the AI app market suddenly hit the brakes in November as the year drew to a close.

According to the latest data, 14 out of the top 20 downloaded AI apps globally in November experienced negative growth, with total download volume shrinking by over 15 million. The decline was particularly notable for Gemini, Gauth, Perplexity, and Sora. On the other hand, despite the setback in overall market growth, AI applications represented byChatGPT and Cici maintained high user retention rates and activity levels, further highlighting their user value.

Which apps bucked the trend and grew? Which sectors are seeing structural differentiation? What changes should developers and publishers focus on? We discuss these details below.

I. "Light AI Tools" Contributed the Largest New Growth

Overall, the AI app market is shifting from"competing for quantity" to "competing for quality." Light tool applications continue to contribute the largest share of new users, while sectors providing high-value services—such as deep creation and emotional companionship—are accelerating in monetization.

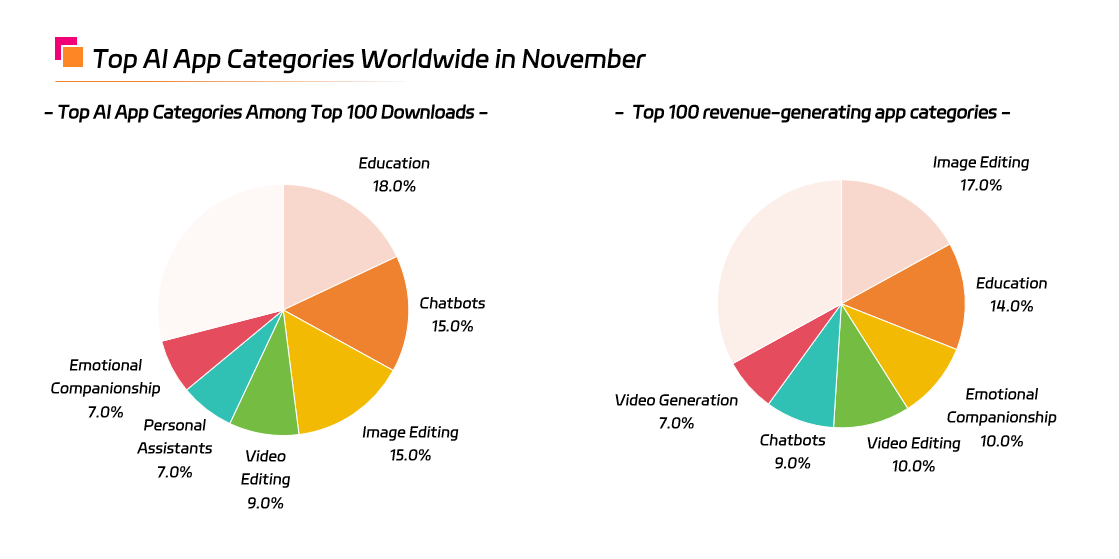

In the Download Charts: Education, Chatbots, and Photo Editing apps remain the largest entry points, accounting for nearly 50% of total downloads combined. These sectors attract massive new user traffic due to their high-frequency, low-barrier nature (e.g., homework help, Q&A, photo retouching). In comparison, Video Editing, Personal Assistants, andEmotional Companionship apps account for a smaller share but maintain stable demand, forming the second tier.

In the Revenue Charts: The structure is different. Photo Editing is the most efficient sector for monetization, accounting for 17%. Traditional tool-type apps like Education, Video Editing, and Chatbots maintain solid revenue. However, Emotional Companionship apps performed exceptionally well; their revenue share (10%) significantly exceeds their download share (7%), demonstrating strong user stickiness and high average revenue per user (ARPU). Meanwhile, Video Generation, though not in the top tier for downloads, is rising rapidly in the revenue charts.

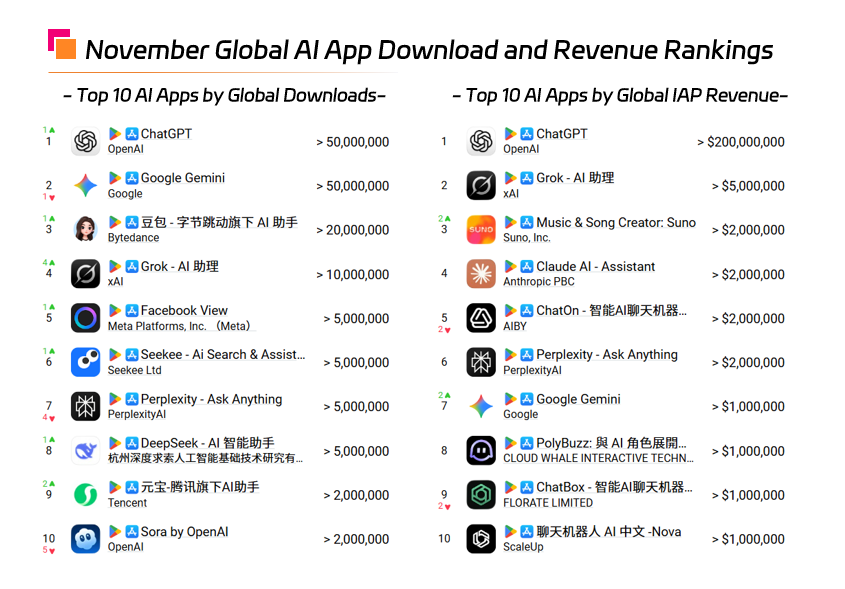

Specific Apps:ChatGPT continues to sit firmly at the top of both the global AI app download and revenue charts. However, Sora, another OpenAI product that exploded in popularity a few months ago, lost momentum in November, with downloads plummeting and its ranking dropping to 10th. Meanwhile, rankings for Doubao, Grok, and Seekee rose. Overall, Chat Assistants still dominate the top 10.

II. "General AI Assistants" Show Strong User Retention

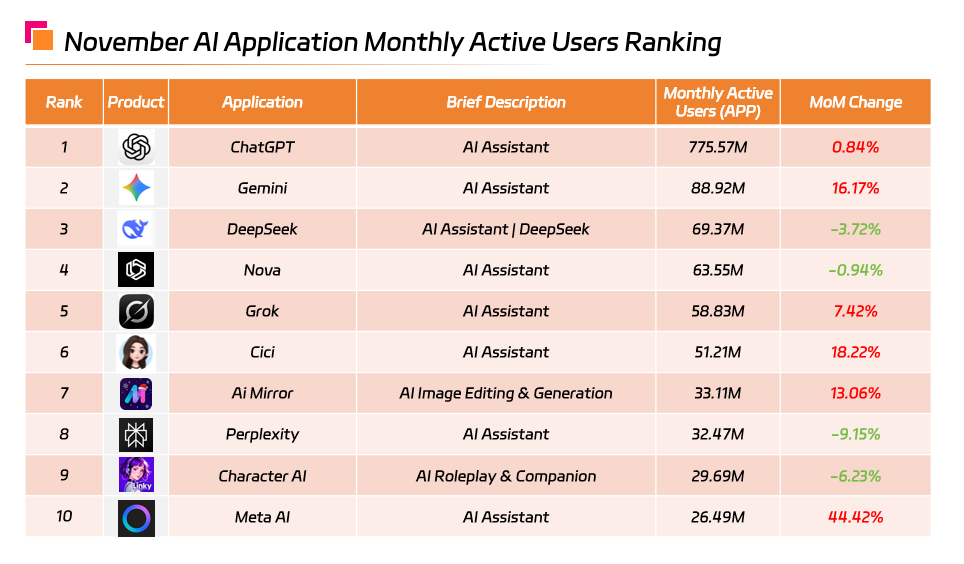

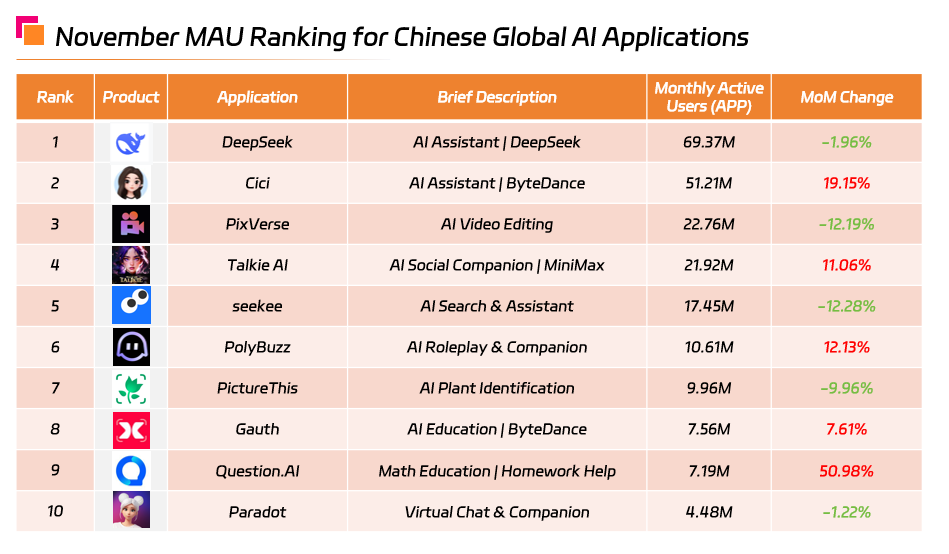

In the November Monthly Active Users (MAU) rankings for the overseas AI market, top applications maintained high user stickiness and retention, with General AI Assistants occupying the dominant positions. ChatGPT sits firmly in the first tier with 770 million MAU, with a solid user base. Apps like Gemini, Grok, Cici, and Meta AI all achieved significant month-over-month (MoM) growth.

Among non-assistant apps: Ai Mirror leads the creative tool sector with 33 million MAU and maintained over 13% MoM growth, reflecting strong demand for AI photo editing/generation and high-frequency usage scenarios.Character AI saw a slight dip in MAU but remained in the top 10.

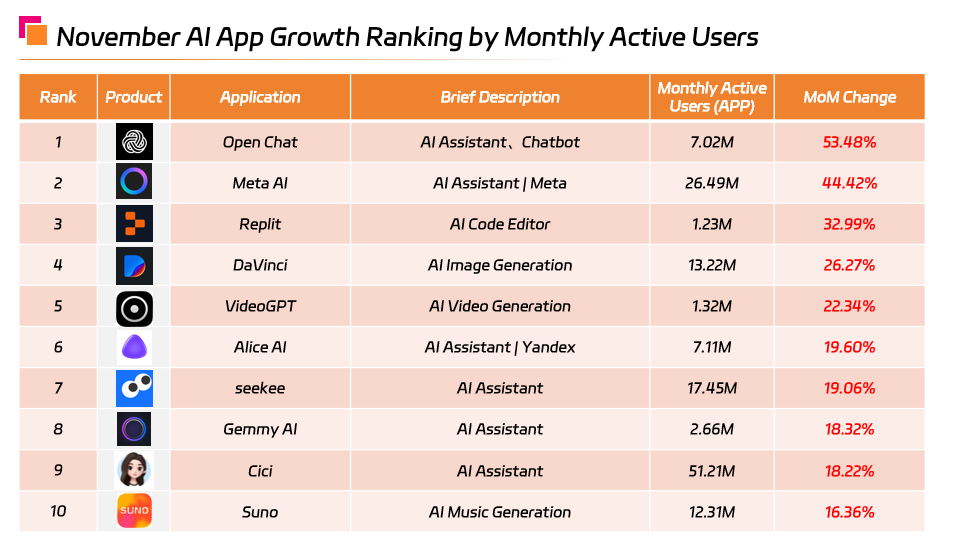

Fastest Growers: The top 10 fastest-growing AI apps in November were still led by General AI Assistants.Open Chat and Meta AI achieved high growth rates of 53% and 44% respectively, driving strong momentum for the entire sector.

On the other hand, AI Creation apps also performed impressively.

DaVinci (Image Gen) andVideoGPT (Video Gen) achieved MAU growth of 26% and 22% respectively.

Suno solidified its lead in AI Music Generation with 16% growth.

Notably,Replit (AI Coding Tool), despite a smaller user base, showed its unique value in the vertical field with a 33% monthly growth rate, demonstrating high commercial potential by focusing on "small volume, high value" scenarios.

The top apps present a landscape of "advancing across multiple tracks with distinct differentiation at the top."

DeepSeek continues to lead with 69 million MAU despite a slight correction.Cici achieved 19% MAU growth, becoming the standout performer among Chinese global apps this month.In contrast, apps like Seekee and PixVerse saw significant declines, likely due to intensified competition with mid-tier tools and rising channel costs.

Companionship, Video Creation, and Education verticals were major highlights for the Chinese global market this month.

Talkie AI and PolyBuzz achieved 11% and 12% MAU growth respectively, proving the sustained appeal and robust user stickiness of Social/Companionship AI in providing emotional value.

In Education, Question.AI saw its MAU jump by 51% MoM. ByteDance'sGauth also maintained steady growth, continuing to consolidate the competitive advantage of Chinese Education AI in the global market.

III. Hot AI App Analysis

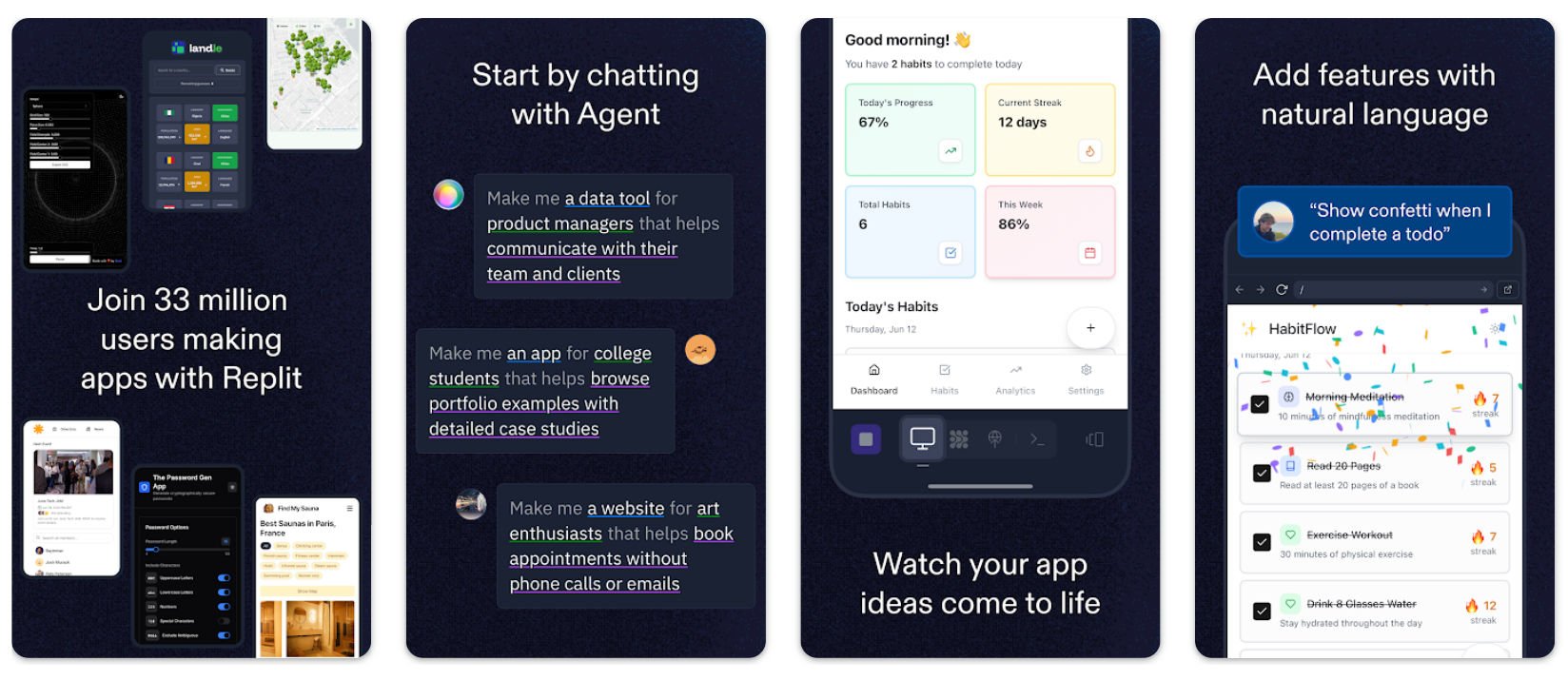

AI Coding Tool — Replit

Replit is an AI-native development tool that allows users to complete the entire process from development to deployment on mobile using natural language. Functionally, its advantages lie in a low barrier to entry, smooth real-time completion and debugging, and enterprise-grade compliance capabilities (such as private deployment, SSO, etc.). This makes it highly attractive to makers, students, and small-to-medium teams.

It is reported that Replit has surpassed 5 million downloads, and its ARR (Annual Recurring Revenue) broke the $100 million mark between January and September 2025. Driven by the "AI-Native Development" wave and surging global demand for low-barrier development,Replit is cutting into a high-growth market expanding from professional developers to mass users.

Image courtesy of Replit

AI Image Generation — AI Mirror

AI Mirror saw its MAU surge 13.06% MoM to 33 million in November, leading the AI Creative App sector. This product belongs to the strong-entertainment category of AI visual apps. Through a large number of style templates, face-swap effects, and one-click generation mechanisms, it satisfies users' needs to quickly "produce content" for short videos and social media, giving it natural virality and high initial conversion capability.

However, this category is also limited by homogenized competition, ad experience issues, stability of generation quality, and compliance risks associated with face-swapping features. Therefore, for AI Mirror to improve long-term retention and monetization, it needs further breakthroughs in content quality, user experience optimization, and high-value creation scenarios.

Image courtesy of AI Mirror