Non-Game App Installs Surge as Short-Drama, E-Commerce, and Other Chinese Apps Race to Capture Brazil!

Brazil—South America's largest economy and one of the world's most promising emerging markets—is attracting accelerating global investment and technological expansion. Data shows that in 2024, Brazil's GDP grew by 3.4%, marking its fourth consecutive year of economic expansion.

Meanwhile, as internet penetration rises, online consumption habits solidify, and demand for high-value, high-entertainment content continues to grow, Brazil is rapidly becoming a key growth market for non-gaming apps. Short-drama, e-commerce, food delivery, tools, and other verticals are showing strong user momentum, with advertisers increasing their spend to capture mindshare.

But beneath the surface of seemingly limitless opportunity, which categories are truly breaking out—and which apps are leading the charge? Let's look at the data.

1. A Booming Mobile Market: Non-Game Apps Become the New Growth Engine

With stable economic growth and a large, young, and highly connected population, Brazil's mobile ecosystem continues to expand.

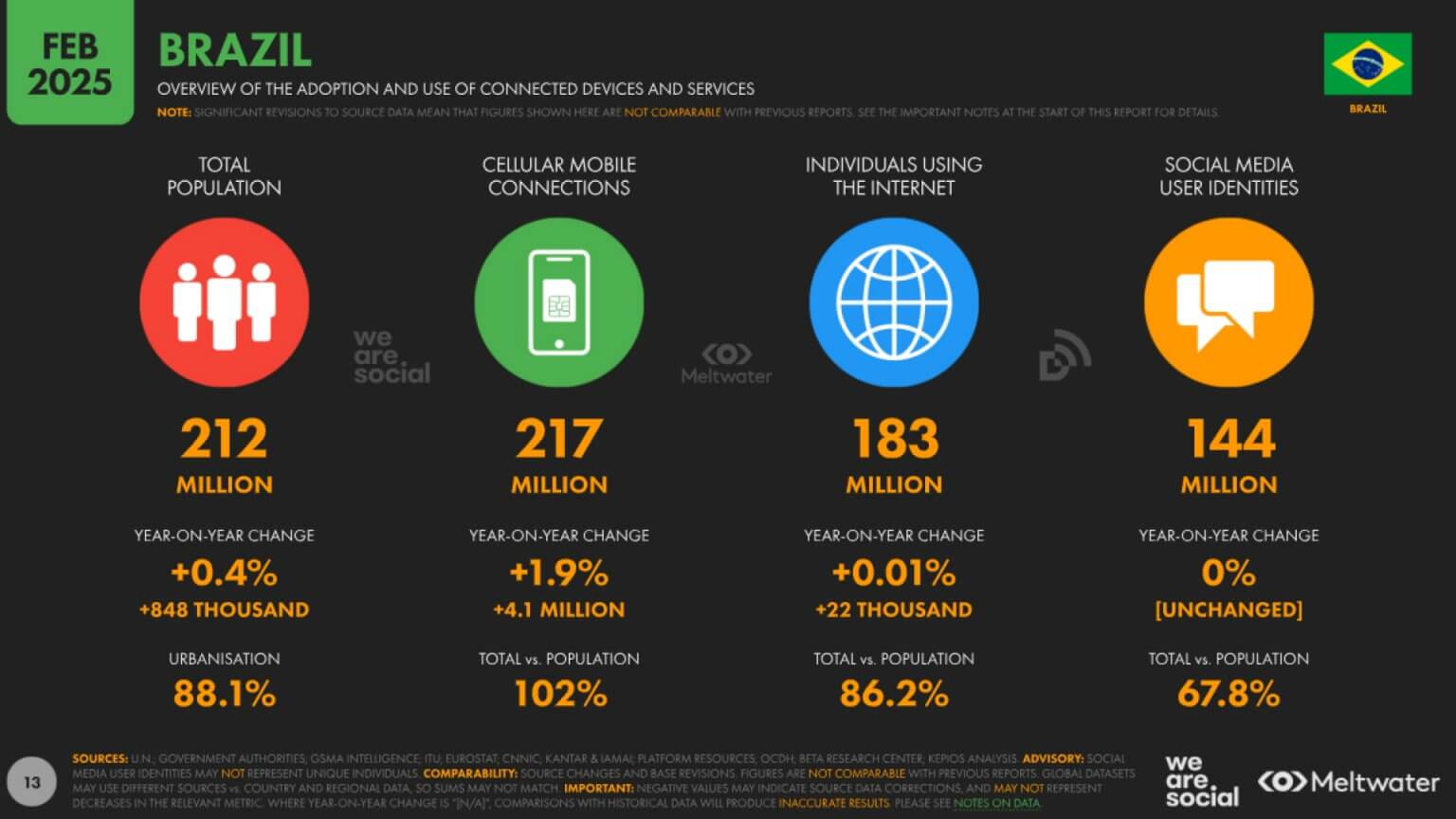

According to Meltwater, Brazil's population reached 212 million in 2025 (+0.4% YoY).Internet penetration rose to 86.2%, and SIM penetration reached 102%.Brazil's demographic profile remains young, with an average age of 34.8; women account for 50.8%, men 49.2%—creating a highly active user base with strong online spending potential.

Brazil Mobile Market Overview — Source: Meltwater

AppsFlyer data shows that installs of non-gaming apps—after years of plateauing—grew 9% YoY in 2024, while gaming installs declined 2%.The trend is clear: users are gravitating toward apps that provide practical, everyday value.

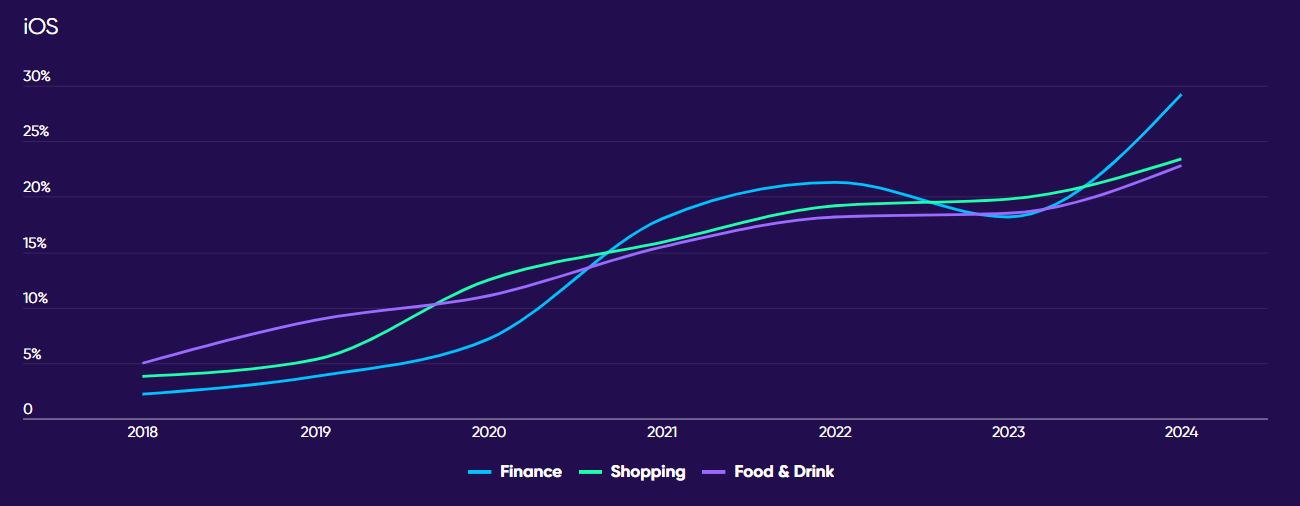

Overall Install Trends by Vertical — Source: AppsFlyer

On iOS, non-gaming installs jumped 19% YoY, led by finance apps, whose installs surged 60%, surpassing shopping and food delivery.

On Android—which still accounts for 90% of all installs—finance slowed (-10%), while shopping and food delivery stabilized as pandemic-era windfalls faded. With digital behavior normalizing, Brazil is entering a “habit economy,” where apps that save users time and money earn long-term retention.

Key Vertical Trends by Platform — Source: AppsFlyer

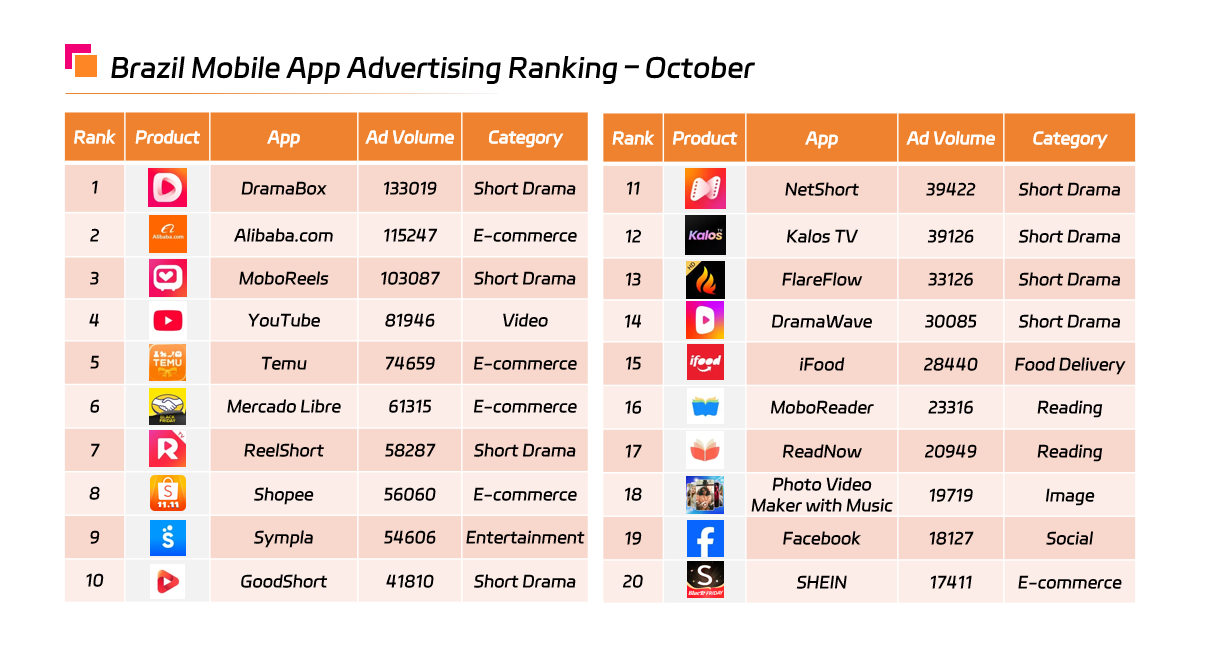

As a high-potential market, Brazil's user acquisition (UA) competition is intensifying. AppsFlyer notes that Brazil is now the 4th largest UA ad-spend market globally, trailing only the U.S., India, and the U.K.

Notably, Chinese companies account for 50% of all UA spending in Brazil—a sign of both long-term confidence and accelerated localization efforts.

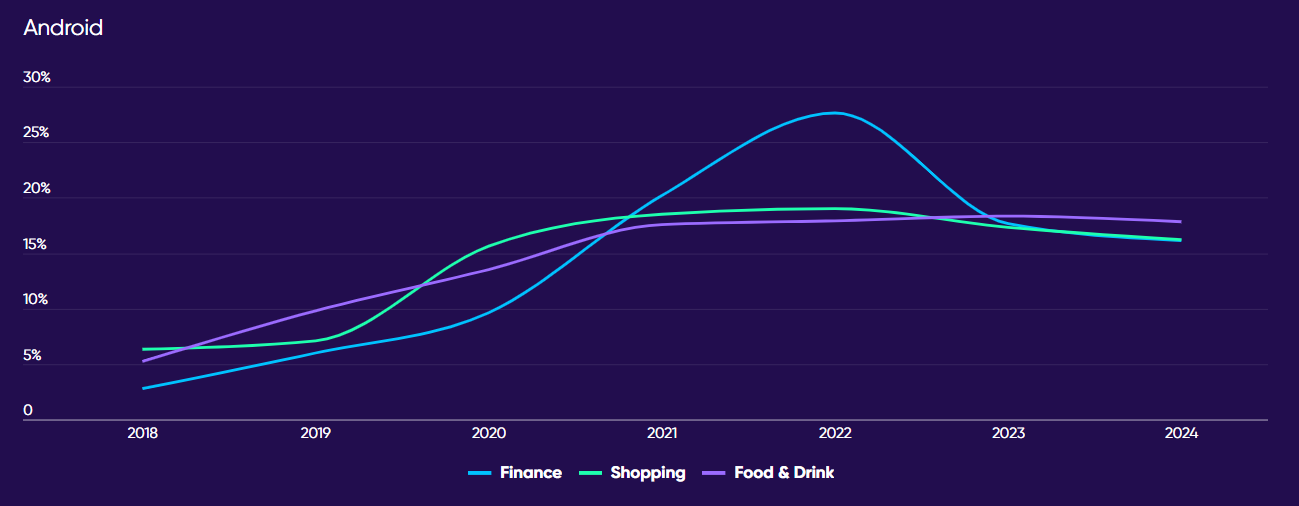

Looking at Brazil's Top 20 ad spenders in October, the trend becomes even clearer:Short-drama apps and e-commerce apps dominate the list, with nearly 90% coming from Chinese publishers.Short-drama leaders include DramaBox, MoboReels, and ReelShort, while e-commerce is led by Alibaba.com, Temu, and SHEIN.Their rapid expansion not only fuels overall non-gaming growth but also strengthens China's competitive presence in Brazil.

Source — NetMarvel

2. Explosive Demand Makes Brazil a Top-Three Market for Short Drama

Thanks to its large user base and growing appetite for mobile video content, Brazil's short-drama market surged in 2025. In downloads, Brazil consistently ranked Top 3 globally from 2024 Q3 to 2025 Q2.

China's short-drama "Big Three" saw strong results in Brazil during 2025 H1:

DramaBox (Jiuzhou Culture): 10.85 million downloads

ReelShort (Maple Leaf Interactive): 9.25 million

GoodShort (New Reading Times): 8.85 million

On ReelShort, the Brazilian version of "My Billionaire Husband's Secret Life" generated 440 million views in just two months.

Image:Official Stills — “My Billionaire Husband's Secret Life”

Revenue performance is equally impressive. Brazil ranked in the global Top 10 for short-drama revenue in 2025 H1, and since 2025 Q1 it has stayed in the Top 5 for two consecutive quarters—indicating strong willingness to pay and solid ARPU potential.

Core drivers of this growth include:

A large, young, mobile-first population

Heavy reliance on smartphones for entertainment

Cultural preference for high-emotion, high-conflict, high-twist storytelling—perfectly aligned with the short-drama format.

With continued investment from Chinese publishers, Brazil's short-drama industry is entering a golden growth phase.

3. E-Commerce, Mobility & On-Demand Services Are Rising Fast

Beyond short drama, Brazil's lifestyle and consumption apps are also expanding rapidly.

Brazil's e-commerce landscape is shaped by competition between Chinese and domestic giants.Chinese platforms—Alibaba.com, Temu, SHEIN—continue aggressive investment backed by supply-chain and cost-efficiency advantages.Meanwhile, local leader Mercado Libre remains dominant thanks to strong logistics and brand recognition.This multi-platform competition drives higher penetration and consumption frequency.

Temu, despite being in Brazil for only 18 months, has already captured 9.9% market share—surpassing Shopee to become the #2 e-commerce platform.

Mobility, food delivery, and instant services are also gaining momentum.Didi's overseas brand 99: Corridas, Food, Pay maintains strong activity in major cities, consistently ranking Top 10 on Google Play's free charts.Local giant iFood continues to lead with its large user base and delivery network.As users increasingly rely on online food delivery and ride-hailing, these apps are growing not only in downloads but also in retention and monetization depth.

Source — AppMagic

4. Helping Advertisers Unlock Brazil's Growth Potential

As Brazil's mobile ecosystem accelerates, short-drama, e-commerce, and on-demand apps are racing to scale—bringing fiercer UA competition. To win in this environment, advertisers need not only precise buying strategies but also high-quality traffic and trustworthy, verifiable data to optimize performance.

This is where NetMarvel is becoming a key partner for global advertisers in Brazil.

With:

a deep local traffic network

advanced algorithmic optimization

strong understanding of Brazilian user behavior

NetMarvel provides advertisers with more predictable, scalable, and efficient growth paths.

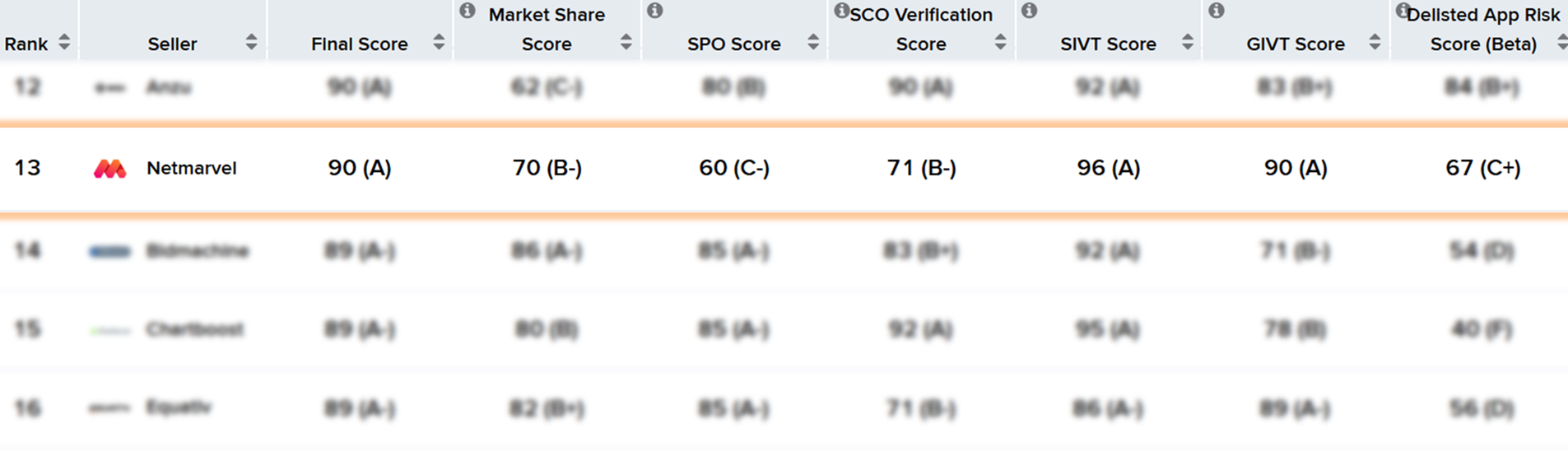

In Brazil's Top Mobile SSP rankings, NetMarvel ranks among the leaders, earning recognition from advertisers for traffic quality and campaign performance.Chart: Pixalate

Through deep market insights, localized execution, and technology-driven growth, NetMarvel is partnering with more short-drama, e-commerce, and on-demand apps—helping them achieve scalable user acquisition and long-term value growth in Brazil.