Global Digital and Gaming Industry Outlook 2025: The Era of Regulation, Compliance, and Transparency

In October 2025, the European gaming community was shaken by an open letter.

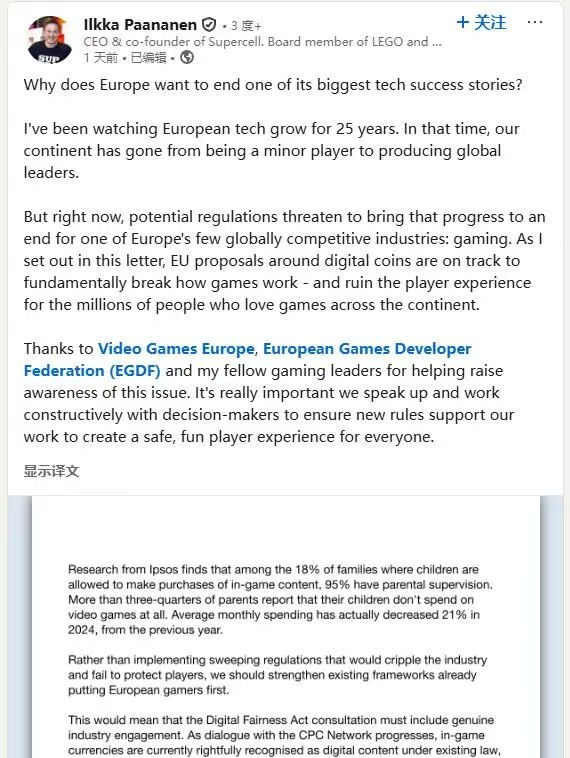

Supercell CEO Ilkka Paananen published a letter titled “Don't Kill Europe's Few Tech Success Stories,” warning that the EU's proposed Digital Fairness Act (DFA) and CPC Consumer Protection Guidelines could heavily impact Europe's €27 billion gaming industry.

The most controversial clause would classify in-game currencies as financial assets, subjecting every virtual token transaction to financial compliance rules. Developers would need to treat each token use as an independent financial transaction—a move that could impose massive compliance burdens across thousands of games.

Paananen argued that this approach “fails to protect players effectively and risks stifling innovation and user experience.” He compared game tokens to “theme park coins”—a lightweight, fun mechanism now facing heavy legal constraints. This debate not only represents a clash between Supercell and EU regulators but also reflects a global shift: the digital and gaming industries are moving from free innovation to regulated governance.

1. Europe: Digital Regulation Enters the Deep Waters

Over the past three years, the EU has enacted the Digital Markets Act (DMA), Digital Services Act (DSA), and AI Act, forming the world's most comprehensive digital regulatory framework. The upcoming Digital Fairness Act (DFA) marks an even deeper expansion—targeting platform competition, developer ecosystems, and algorithmic transparency.

App Distribution and Revenue Reform:

Under the DMA, Apple and Google are now required to open third-party app stores and payment systems.

The DFA focuses on misleading marketing, addictive design, and opaque digital pricing, pushing platforms to disclose algorithmic logic and data access rules.

Supercell's challenge targets these “algorithm transparency” and “revenue-sharing” provisions, arguing they harm business confidentiality and innovation.

AI Content and Virtual Advertising:

The AI Act mandates clear labeling of AI-generated content in games and social apps.

Ad campaigns and virtual item promotions must comply with new transparency standards—reshaping monetization models.

Privacy and Cross-Border Data:

The GDPR 2025 revision strengthens “data portability” and introduces “cross-border review mechanisms.”

Gaming companies must revalidate server localization, data authorization, and ad-targeting systems.

While EU policies enhance consumer protection, they also raise development and operational costs. For Chinese, Japanese, and Korean publishers, balancing compliance costs and market returns has become a central challenge.

2. United States: Privacy and Antitrust in Continuous Tug-of-War

Unlike the EU's centralized model, U.S. digital policy remains fragmented, combining state-level laws with federal oversight. In 2025, three major shifts are taking shape:

Children's Privacy and Game Regulation:

States like California and New York passed COPPA 2.0, tightening restrictions on in-game advertising and purchases targeting minors.

Developers must disclose algorithmic recommendation logic and virtual currency transactions—reshaping monetization strategies for casual and simulation games.

Antitrust and Platform Ecosystems:

Microsoft, Meta, and Apple remain under FTC scrutiny for “cloud gaming dominance” and “ecosystem bundling.”

The U.S. encourages open distribution and advertising environments, creating new opportunities for small and mid-sized developers.

AI Content and Ad Transparency:

The AI Transparency Act (2025) requires that all AI-generated ad content be labeled.

Game ads and UGC must comply with stricter “misleading advertising” audits.

Although still the world's largest digital and gaming market, the U.S. policy focus has shifted toward consumer protection and platform accountability. Developers must enhance user data compliance, youth safety features, and AI disclosure practices.

3. Asia: Steady Regulation and Policy-Driven Upgrading

China:

China continues promoting the global expansion of its gaming industry but now emphasizes high-quality, compliant, and globally integrated growth.

The Pilot Program for Expanding Service Industry Opening-Up includes gaming as part of national strategic projects—from IP creation to overseas operations.

The Ministry of Commerce's 2025–2026 Key Cultural Export Enterprises and Projects list officially incorporates gaming exports, with funding support for qualified titles.

Japan and South Korea:

Both countries combine regulation with domestic industry protection and innovation incentives.

Japan: Revised the Unfair Competition Prevention Act to ban unauthorized modding and code trading, introduced a new consumption tax requiring a 10% withholding from non-local developers, and advanced policies such as Sō-Fu, Payment Services Act revisions, and “Cool Japan” developer initiatives.

South Korea: Abolished the GRAC pre-screening system, adopted a negative-list approach, mandated loot-box probability disclosure, and established a ₩112.3 billion fund to support AI gaming and esports legislation.

4. Conclusion: The Rise of “Regulated Growth”

2025 marks a turning point—the global digital and gaming industries are transitioning from free growth to regulated growth. Regulation doesn't signify decline; rather, it indicates maturity.

For Chinese developers, future competitiveness depends not only on product quality and marketing capability but also on compliance literacy—the ability to navigate complex global regulatory systems while sustaining innovation.

The winners of this new era will be those who can balance technology, creativity, and compliance to achieve sustainable global growth.