Short Drama Apps Insights: Chinese Developers Dominate 2025 Q3 Apps Revenue Rankings

Entering 2025, short drama apps have become one of the most dynamic segments in the global mobile market. According to Sensor Tower, short-form drama apps once again dominated the Chinese overseas non-game app rankings in Q3, with titles such as ReelShort, DramaBox, and GoodShort making the top 10 in revenue. Meanwhile, DramaBox, ReelShort, and NetShort also secured spots among the top 20 most-downloaded Chinese overseas apps, underscoring the global penetration and commercial maturity of this category.

Once defined by “speed” and “scale,” the short drama industry is now transitioning from explosive growth to refined, data-driven operations. With more diversified content supply, mature monetization models, and ecosystem development, short dramas are evolving from a pure “traffic game” into a sustainable global content business.

1. Market Overview – Q3 2025

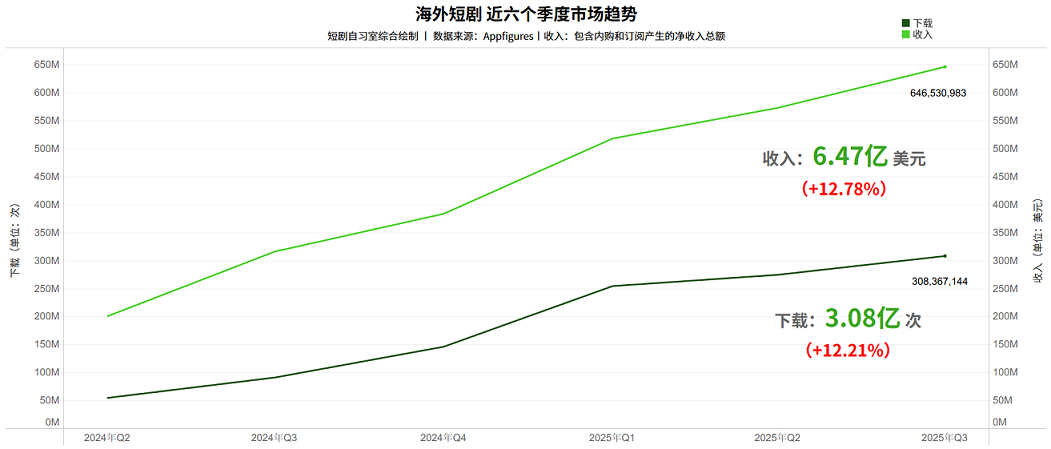

According to Appfigures, the global short drama app market maintained strong momentum in Q3 2025.

Across 298 tracked apps, total downloads exceeded 308 million, up 12.21% quarter-on-quarter, while revenue reached $647 million USD (≈ RMB 4.6 billion), marking 12.78% growth QoQ — a testament to robust user engagement and monetization potential worldwide.

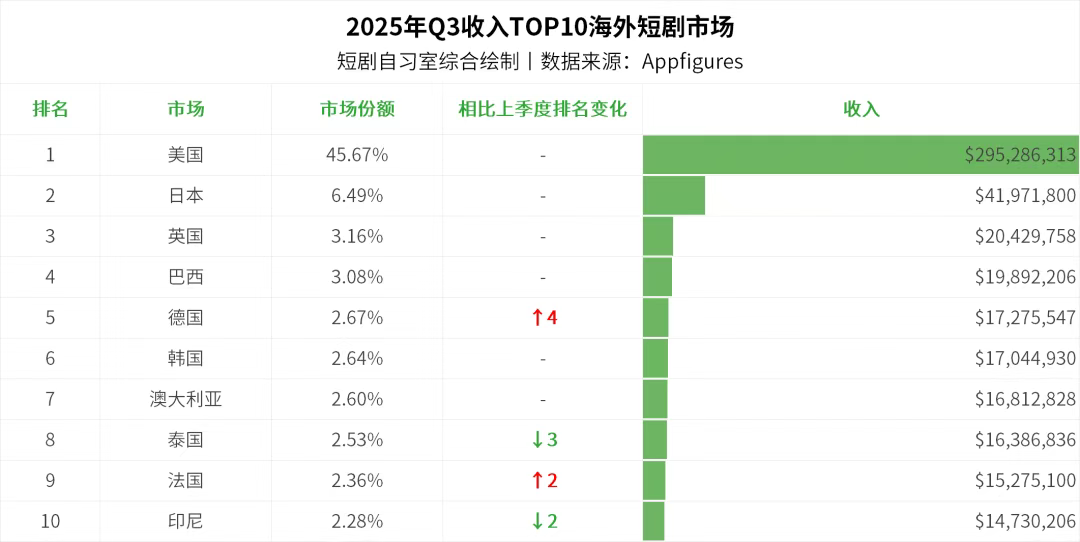

The market is becoming more diverse, but North America and Europe remain the core revenue drivers.

The top 10 revenue-generating markets were the United States, Japan, the United Kingdom, Brazil, Germany, South Korea, Australia, Thailand, France, and Indonesia. Notably, France entered the top 10 for the first time, fueled by the ongoing popularity of ReelShort and DramaBox across Europe.

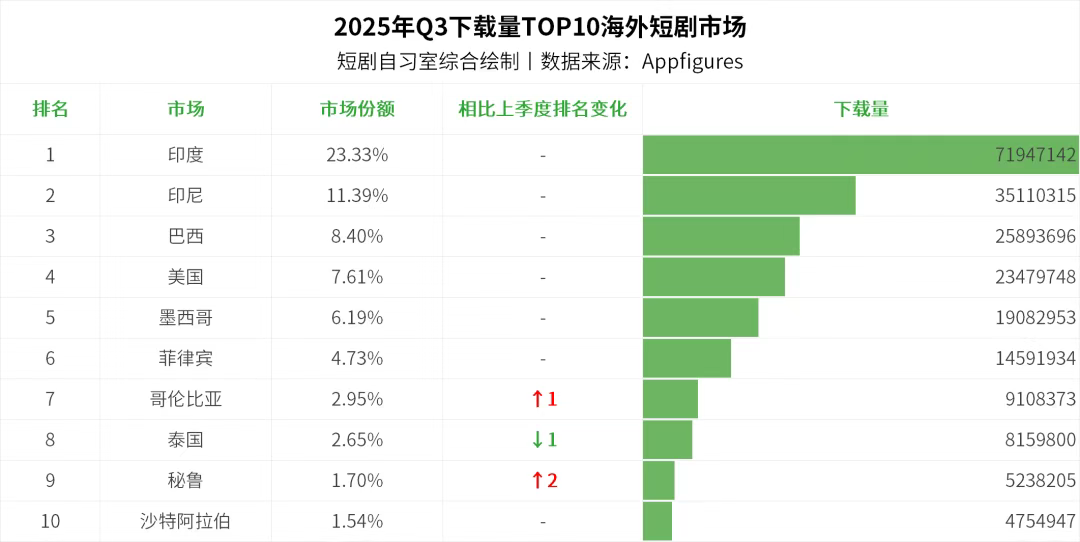

Meanwhile, emerging markets are quickly becoming new growth engines.

The top 10 countries by downloads include India, Indonesia, Brazil, the U.S., Mexico, the Philippines, Colombia, Thailand, Peru, and Saudi Arabia. Among them, Peru’s debut reflects the genre’s successful expansion into Latin America and the Middle East, driven by DramaBox and ReelShort’s strong regional performance.

2. Global Marketing Landscape

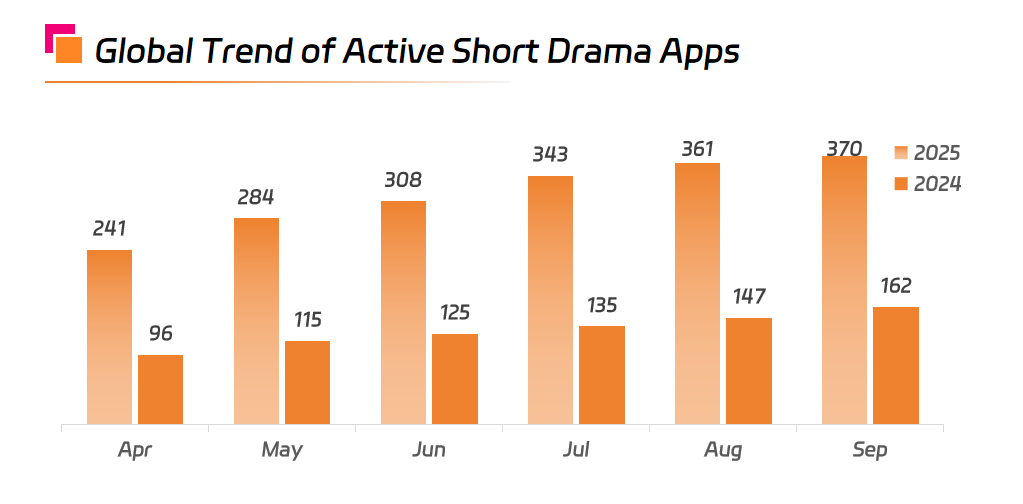

Marketing activities have intensified in parallel with the global expansion of short drama apps. From April to September 2025, the number of active advertising apps grew from 241 to 370, more than doubling year-on-year. Competition across paid acquisition channels has become significantly more fierce.

Over the past six months, advertising volumes showed a “high start – correction – stabilization” trend. April to June marked the peak investment phase, as new platforms launched aggressively and top players expanded their footprint. Since July, the market entered a rational adjustment period. Advertisers shifted toward creative optimization, precision targeting, and long-term user value cultivation — signaling the start of a more mature growth cycle.

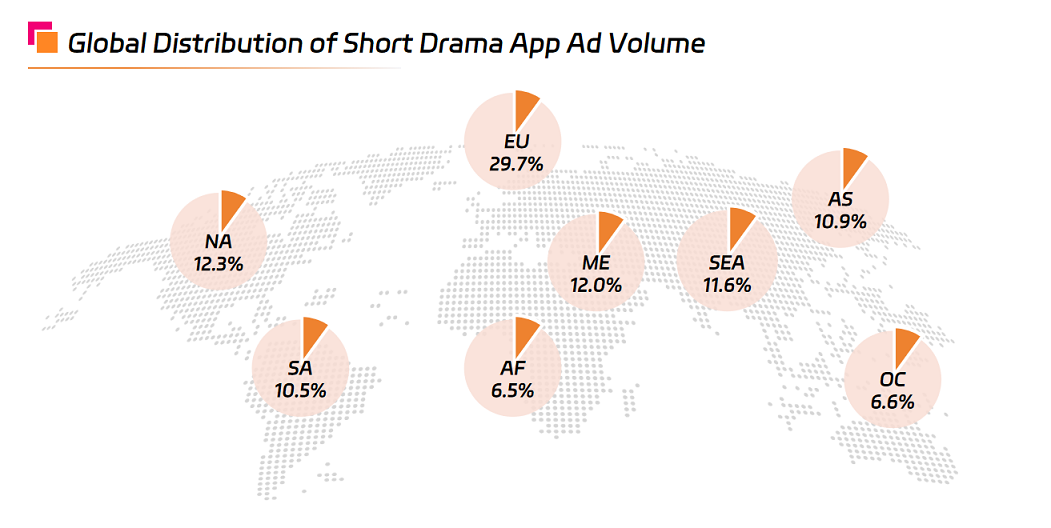

Regional ad distribution shows that Europe leads with 29.7% of total ad impressions, followed by North America (12.3%), the Middle East (12.0%), Southeast Asia (11.6%), and other Asian regions (10.9%). Europe’s dominance reflects its strong purchasing power, developed ad ecosystem, and openness to new content formats, while Southeast Asia and MENA continue to rise as high-growth regions for Chinese publishers.

3. Top Global Advertisers in Q3 2025

The Q3 global ad rankings reveal a market that is increasingly top-heavy yet dynamic.

- MoboReels led the pack with 7.4 million ad creatives, maintaining a commanding lead thanks to aggressive investment and multi-channel strategy.

- DramaBox and ReelShort followed with 3.2 million and 2.1 million creatives, respectively, forming a solid top-tier cluster that together accounted for nearly half of all global ad placements.

These leading titles have solidified their brand recognition and user mindshare worldwide.

In the mid-tier, rising players such as DramaWave, NetShort, and MiniShorts leveraged niche themes and segmented audience strategies to carve out their own space, each exceeding the 1 million creative mark. Meanwhile, new entrants like FlareFlow, My Drama, and Kalos TV broke into the rankings rapidly, highlighting the market’s high fluidity and strong potential for new breakout hits.

Overall, the Q3 data shows that the short drama app market has entered a dual-track phase — where user acquisition and brand building go hand-in-hand. Top players continue to strengthen their market dominance, while mid-tier developers drive innovation through localized content, refined targeting, and diversified growth strategies.