Winning Q4: How Shopping Apps Can Capture the Peak Season Surge

With global economic recovery accelerating, consumers’ purchasing power and willingness to spend are on the rise. As the traditional peak season for consumption, Q4 plays an increasingly vital role in driving annual sales.

Key Shopping Events in Q4 2025

Halloween (October 31): A Western holiday centered around costumes and entertainment, mainly celebrated by families and young consumers.

Thanksgiving (November 27): A major family gathering and shopping occasion that boosts demand for food, home goods, and gifts.

Black Friday & Cyber Monday (November 28–December 1): Originating in the U.S., these are now the largest global shopping festivals.

Christmas (December 25): The world’s most festive shopping event, with strong online spending momentum.

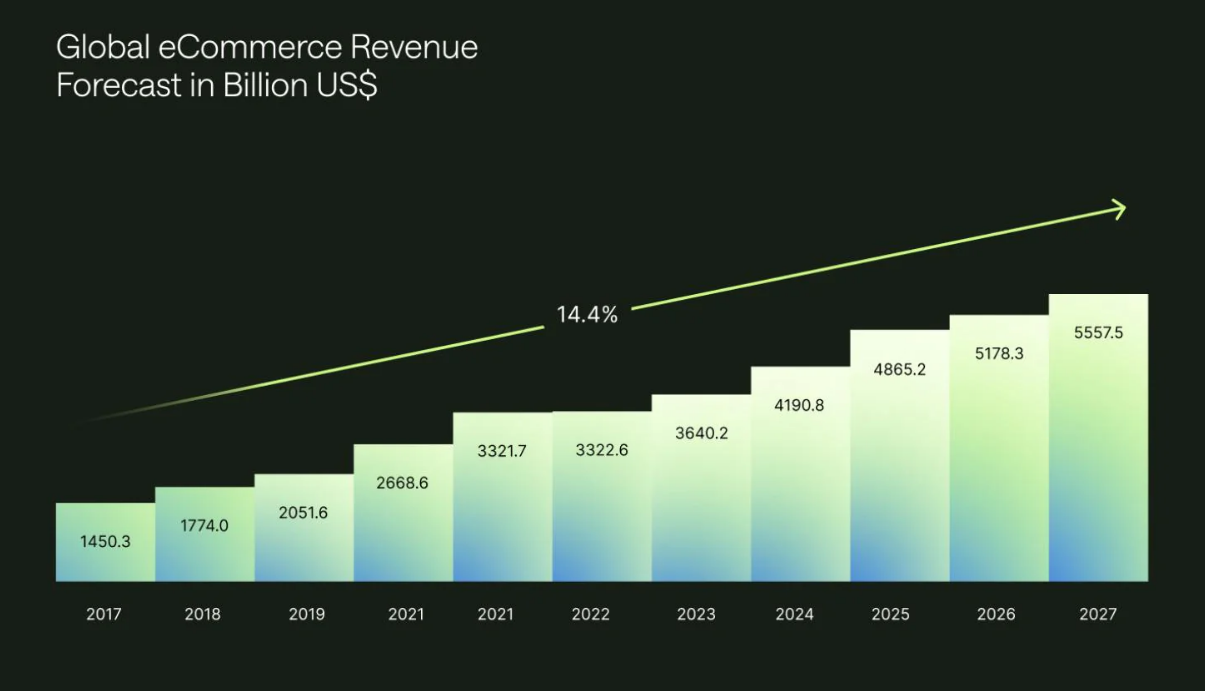

In 2024, global e-commerce reached $4.2 trillion, up 15% year-over-year, with Q4 accounting for 30% of annual sales. This momentum is expected to continue into 2025, when total market size could reach $4.8 trillion, with an even larger share coming from Q4.

Source: Shopify

As festive promotions and year-end shopping sprees intensify, competition among shopping apps is heating up. To secure market share, platforms must find new ways to stand out in a saturated space.

01. Q4 E-commerce Advertising Trends

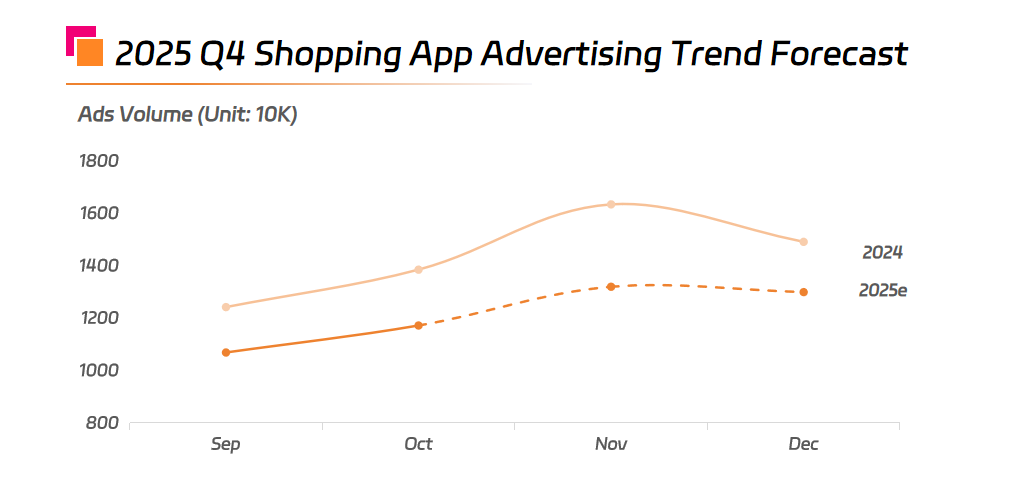

Between September and December 2024, global e-commerce ad spending followed an inverted “U-shaped” curve—rising in September, peaking in October–November (around Double 11 and Christmas), then slightly tapering off in December while remaining high overall.

In 2025, cautious consumer sentiment and ROI-driven advertising strategies have led to a more restrained approach. Advertisers are focusing on precision marketing and profitability rather than sheer ad volume. September ad volume dropped 14% year-on-year, though Q4 remains the most critical acquisition and conversion window.

Source: NetMarvel

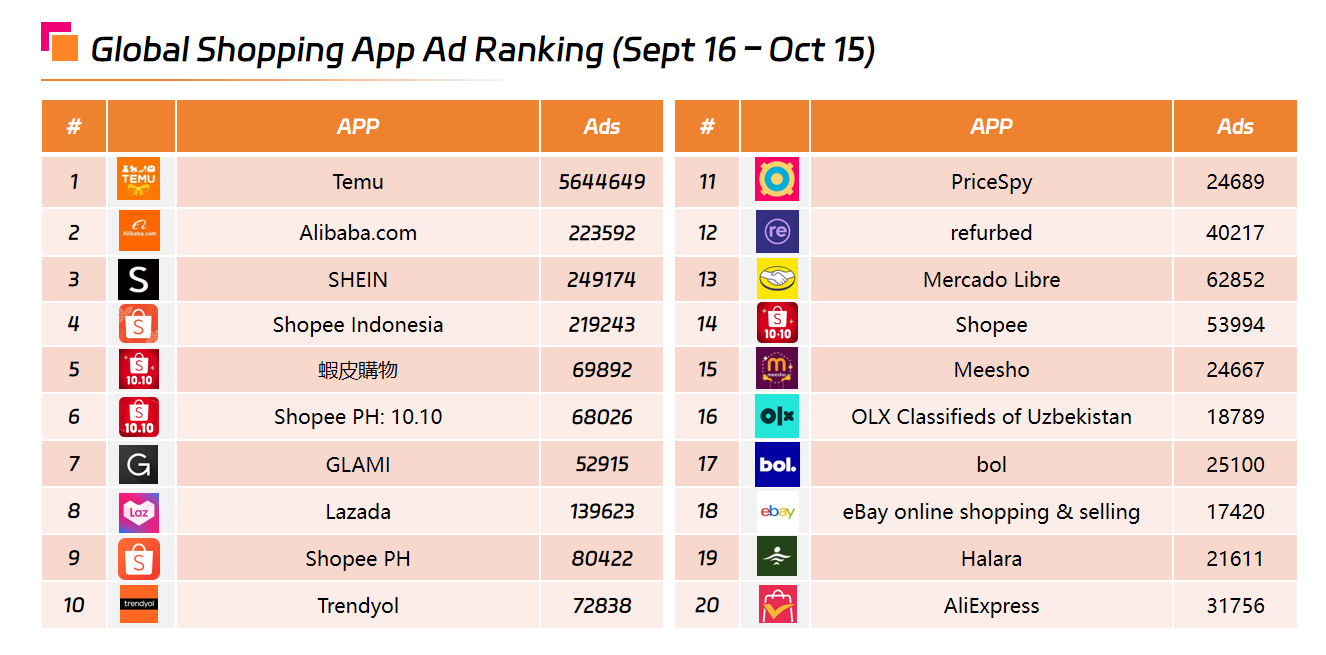

In the latest 30-day data, Temu dominated with over 5.64 million ad creatives, far surpassing Alibaba.com and SHEIN, maintaining its global lead.

Competition in Southeast Asia is particularly fierce: Shopee invested heavily across Indonesia, the Philippines, and Taiwan with over 400,000 ad sets, while Lazada, Trendyol (Turkey), and Mercado Libre (Latin America) intensified efforts in their respective markets.

Source: NetMarvel

Two clear trends emerge:

Consolidation of power among top players — Temu, SHEIN, and Shopee form the core global traffic cluster.

Regional diversification — Southeast Asia and Latin America are becoming new growth hubs.

02. Winning Strategies for Q4 Marketing

To outperform competitors during Q4’s high-stakes season, shopping apps must strategically align their marketing timing, media mix, and creative execution.

(1) Marketing Rhythm & Key Phases

Preheat Phase (Late September–Mid October): Focus on brand visibility and festival buildup via social media buzz, influencer campaigns, and soft branding to expand potential user pools.

Burst Phase (Late October–Mid November): Leverage major sales events like Halloween and Double 11 with strong conversion-driven ads such as “Flash Sale” or “Limited-Time Offer” campaigns.

Extension Phase (Late November–Late December): Sustain momentum around Black Friday, Christmas, and year-end sales through remarketing and loyalty programs to drive retention and repurchase.

(2) Channel Selection & Media Mix

A “full-channel reach with strategic focus” approach works best. Continue leveraging high-conversion platforms like Facebook, Google, and TikTok, while expanding into mid- and long-tail DSP networks for cost-effective reach.

Partnering with global performance marketing platforms like NetMarvel DSP allows advertisers to tap into diverse DSP traffic sources, enabling cross-regional targeting, granular optimization, and higher user quality.

Source: NetMarvel

(3) Creative Design & Optimization

Creative differentiation is key during this highly competitive season:

Visuals: Highlight festive atmosphere and brand tone using strong contrasts and recognizable holiday symbols.

Copy: Emphasize limited-time deals and exclusive holiday perks to trigger instant conversions.

Format: Use varied formats like short videos, interactive creatives, and playable ads to enhance engagement.

Source: Temu Ad Creatives

Regular A/B testing and data-driven iteration are essential to optimize creative performance and improve conversion rates throughout the campaign cycle.

03. Conclusion

For shopping apps, Q4 represents the most decisive battleground of the year—a period that can redefine annual performance.

Although competition in 2025 Q4 is becoming more rational, market concentration remains high. Leading platforms dominate user mindshare through continuous exposure and event-driven campaigns, while mid-tier brands must differentiate via smarter channel strategies and ROI optimization to break through cost barriers.

Looking ahead, advertisers will increasingly prioritize regional differentiation, phased planning, and creative refinement—the three pillars of sustainable growth for shopping apps in the global Q4 market.