IAA Mobile Games: Seizing Growth in 'Casualization' Overseas

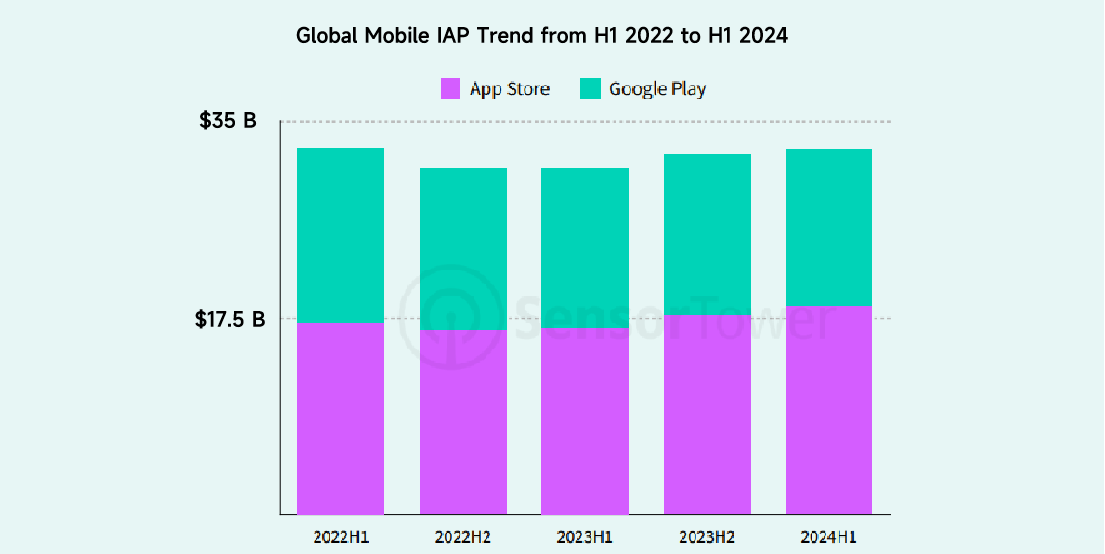

The global mobile game market is facing serious challenges as we enter the stockpiling era. According to Sensor Tower and AppsFlyer data, by 2024, global downloads across both the App Store and Google Play have decreased by 5% compared to the previous year. Additionally, in-app purchase (IAP) revenue has dropped by 2%. Among the hardest-hit categories are medium to heavy mobile games, such as RPG and SLG genres. Despite high ARPPU (average revenue per paying user), market concentration is exceedingly high, with major players dominating the market and new titles struggling to break through.

Against this backdrop of "top-product solidification" and a "lack of new entrants," developers must rethink their strategies for growth in a market where expansion has slowed.

Global Market Recovery in H1 2024

Despite the ongoing market challenges, the global mobile game industry is showing signs of recovery. According to Sensor Tower data, overseas mobile game revenue increased by 6% year-on-year in the first half of 2024, reaching $32.5 billion. Casual games, including puzzle and simulation genres, are driving much of this growth, contributing to the accelerated "casualization" of the market.

"Casualization" of the Mobile Game Market: Two Key Trends

The "casualization" of the mobile game market manifests in two primary trends:

1. The Casualization of Medium to Heavy Games

Traditional medium to heavy mobile games like RPGs and SLGs, known for their complex gameplay and high strategic elements, are adapting to meet the demands of a broader audience. As player time becomes more fragmented, many developers are integrating casual game elements to capture a wider user base. An example is "Last War: Survival," which merged casual mechanics with SLG elements. The game attracted players with light-hearted mini-games like parkour and tower defense, simplifying the strategic aspects to make it more accessible.

2. Transition from Hyper-Casual to Mixed-Casual

Hyper-casual games, with their simple mechanics and easy-to-understand gameplay, have quickly gained popularity. However, as the market saturates, players are losing interest in games with single-core mechanics. To address this, developers are now shifting toward mixed-casual games, which combine elements of hyper-casual games with more complex features. Games like "Magic Tiles 3" and "Survivor.io" have successfully adopted this model, offering engaging experiences while maintaining broad player retention.

Monetization Challenges: IAP and IAA

The growth of casualization is also influencing monetization strategies in the industry. According to AppsFlyer data, in the first half of 2024, global mobile game IAP revenue decreased by 15% on Android and 35% on iOS. However, In-App Advertising (IAA) revenue showed a more resilient growth, especially on Android, where IAA grew by 12%. Categories like hyper-casual, puzzle, and simulation saw the strongest growth in this segment.

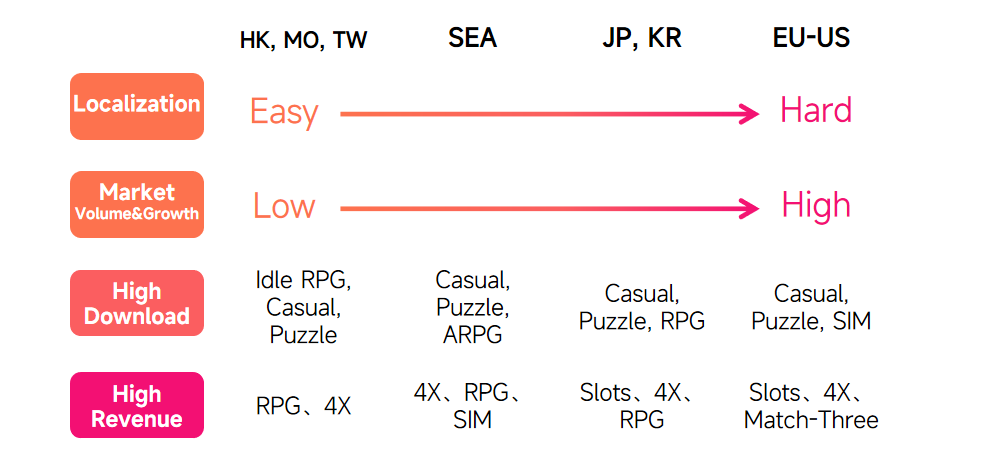

Focusing on the Market and Deep Localization: A Key to Global Success

Localization is critical to the success of any mobile game looking to expand internationally. As cultural preferences, aesthetic tastes, and player types differ across regions, localization strategies must be tailored to each market. The difficulty of localization varies significantly by region.

1. Easier Localization in East Asia

Regions such as Hong Kong, Macau, Taiwan, Japan, and Korea present lower barriers for localization due to shared cultural influences. Developers can more easily adapt their games to meet local preferences. For example, games like "Gum Heroes Legend" and "Little Monster Road" have seen success in these markets by leveraging familiar cultural references and themes.

2. Challenges in Western Markets

European and American markets are more difficult to penetrate due to cultural differences, but they remain lucrative due to their large user bases and high revenue potential. In 2024, data from Sensor Tower showed that mobile game revenue in the United States and Europe increased by 20% and 8%, respectively, despite a decrease in downloads. The preference for hyper-casual games in these regions also provides opportunities for developers to target this audience.

Combatting Competition: The Role of NetMarvel

As the market becomes more saturated, finding new traffic sources and combating internal competition is becoming increasingly difficult. Relying solely on major platforms like Google and Meta may no longer be sufficient to maintain growth.

NetMarvel, as a leading performance marketing platform, offers developers significant advantages in addressing these challenges. With over 500 high-quality products spanning casual, puzzle, RPG, and other categories, and a global user base of over 100 million monthly active users, NetMarvel can help developers reach a wider audience. NetMarvel DSP (demand-side platform) leverages detailed user profiles and behavioral insights to serve highly targeted ads, enabling developers to maximize ad revenue while ensuring high-quality user acquisition. This enables developers to tap into hard-to-reach traffic and focus on more segmented, long-tail user groups.

By using precise targeting and data-driven strategies, NetMarvel helps developers optimize user acquisition, maximize ad revenue, and support their growth in this increasingly competitive environment.

FAQ

1. What are IAA games and how do they work?

IAA (In-App Advertising) games monetize through advertisements shown within the game. Players can interact with ads in various formats (e.g., rewarded video, interstitial ads) in exchange for in-game rewards, enabling a free-to-play model while generating revenue.

2. What is hybrid monetization?

Hybrid monetization combines multiple revenue models, such as IAP (In-App Purchases) and IAA (In-App Advertising), to maximize revenue potential from both paying and non-paying players.

3. How can I monetize my game with IAA?

You can integrate ads like rewarded videos, interstitial ads, and banners into your game. Offering players rewards in exchange for watching ads can help increase engagement and generate steady ad revenue.

4. How to do game localization?

Game localization involves adapting your game to meet the cultural, linguistic, and aesthetic preferences of different regions. This can include translating text, adjusting the game design, and considering local trends and preferences.