2026 Mobile Market Report: Non-Gaming App Revenue Surpasses Mobile Games for the First Time, Accelerating Evolution of Generative AI

The mobile market is shifting away from rapid growth and entering a new phase centered around "value cultivation" and high-quality development. According to Sensor Tower's latest 2026 Mobile Market Report, a landmark change has occurred: non-gaming app revenue has surpassed mobile games for the first time, shaping a new market landscape. This article breaks down the current state of the mobile market and forecasts its future direction.

Macroeconomic Analysis of the Mobile App Market

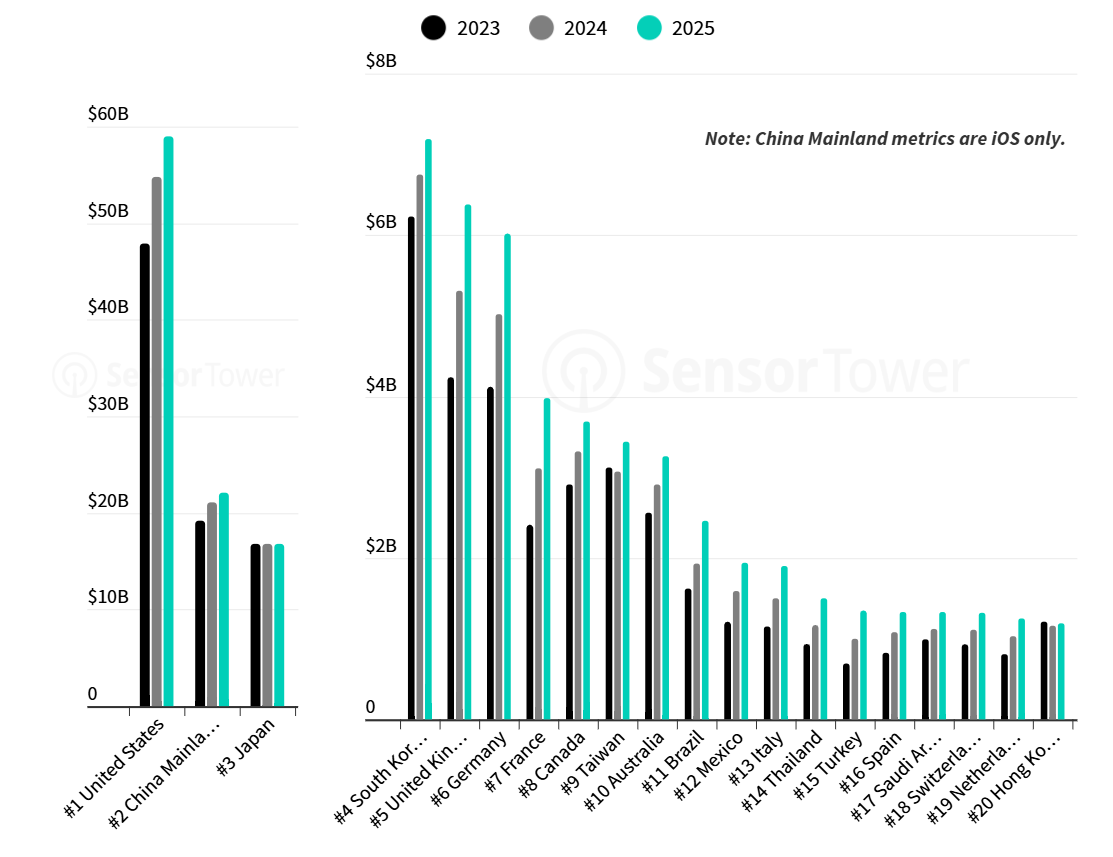

In 2025, the global mobile market showed steady performance. The combined in-app purchase (IAP) revenue of iOS and Google Play reached $167 billion, marking a 10.6% yoy growth, with average user spending per minute reaching $318,000. Regionally, the majority of core markets saw IAP revenue growth between 2023 and 2025. The United States remains the largest market for mobile app revenue, approaching $60 billion in consumer spending in 2025, followed by mainland China and Japan. The Western European market continued to grow, driven by major countries like the UK, Germany, and France.

Top 20 Global Markets for Mobile IAP Revenue in 2025

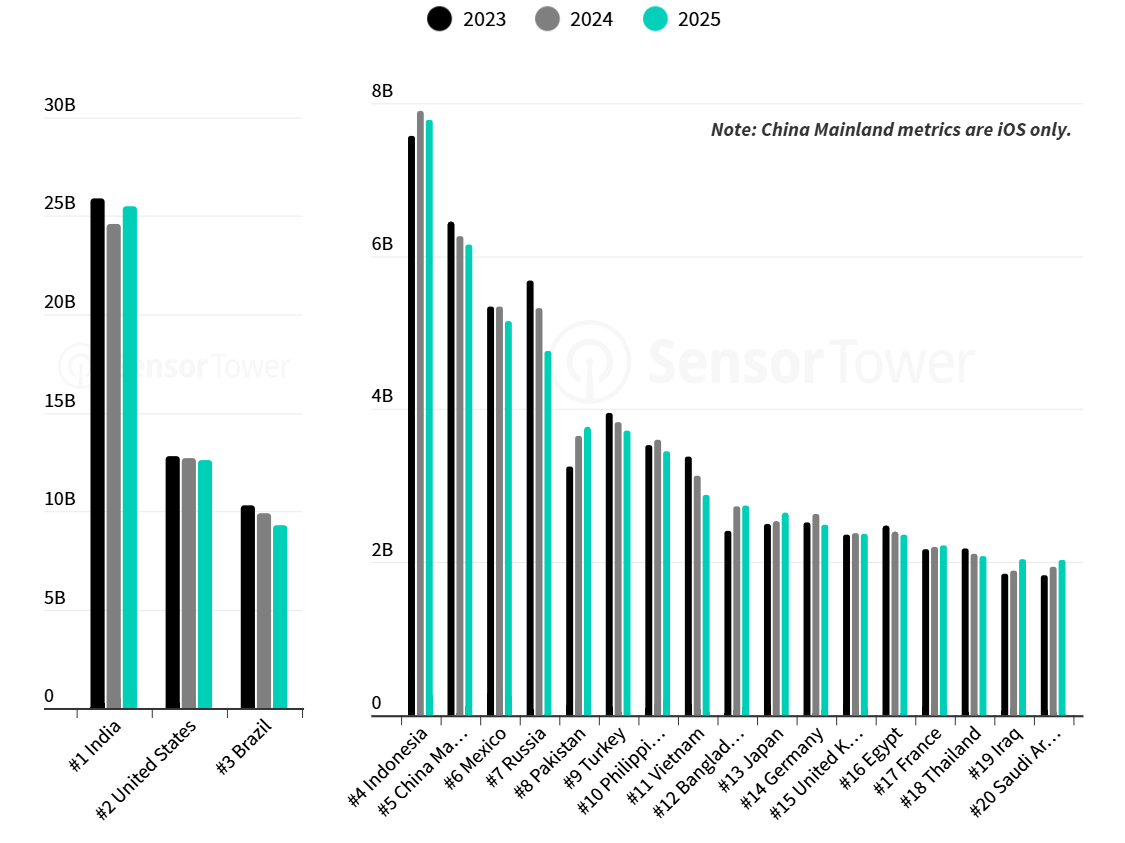

Regarding downloads, global app downloads in 2025 reached approximately 149 billion, a slight increase of 0.8% yoy, with an average download rate of 284,000 per minute. However, despite the overall increase in revenue, only India and Pakistan among the top ten markets for downloads saw year-on-year growth. India, in particular, rebounded strongly in 2025 after a significant drop in 2024, becoming a key driver of global download growth.

Top 20 Global Markets for Mobile App Downloads in 2025

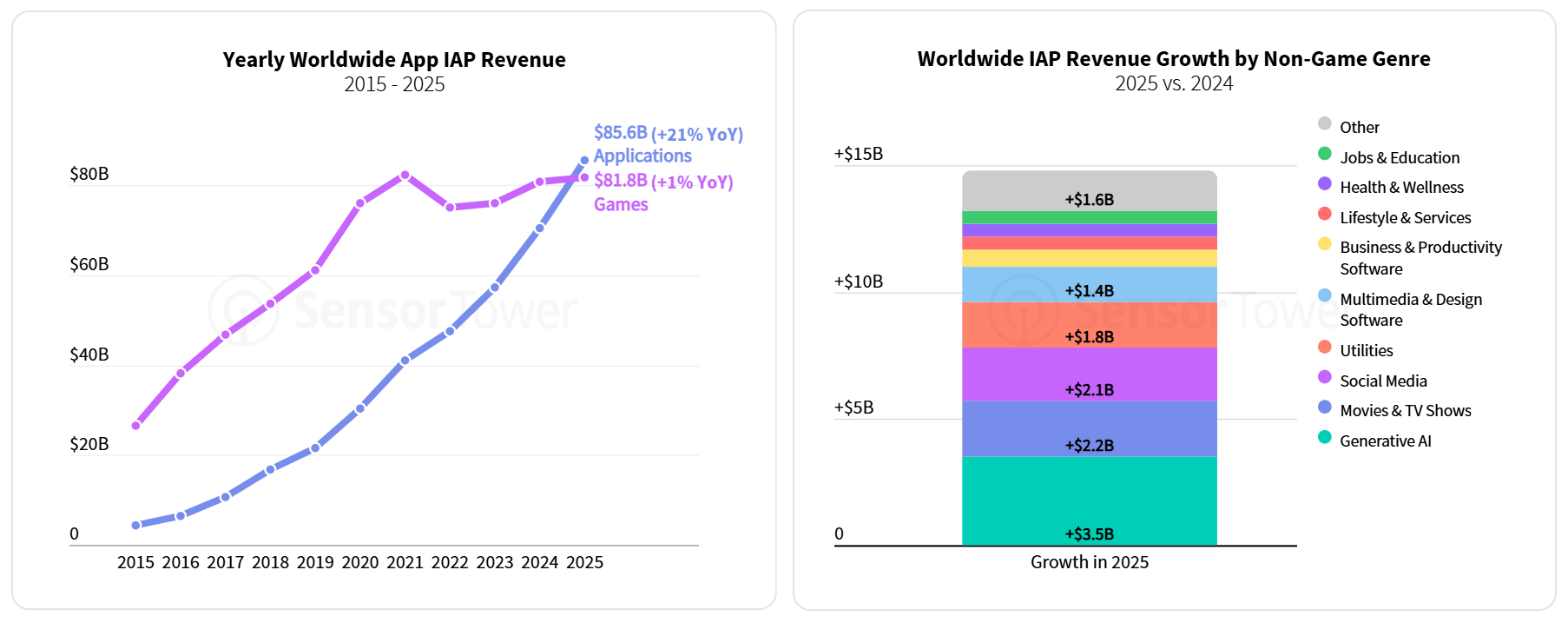

A notable development is the rise of non-gaming apps, which continued to climb in 2025, reaching a historic milestone: for the first time, non-gaming app IAP revenue surpassed mobile games, totaling $85 billion, a 20% increase from the previous year—nearly 2.8 times its value five years ago. Almost every non-gaming category experienced positive IAP growth, signaling a significant improvement in user retention and monetization depth.

IAP Revenue Trends (2015–2025), 2025 vs. 2024 Global Non-Gaming Categories IAP Growth

Non-Gaming Apps: The Rise of Generative AI

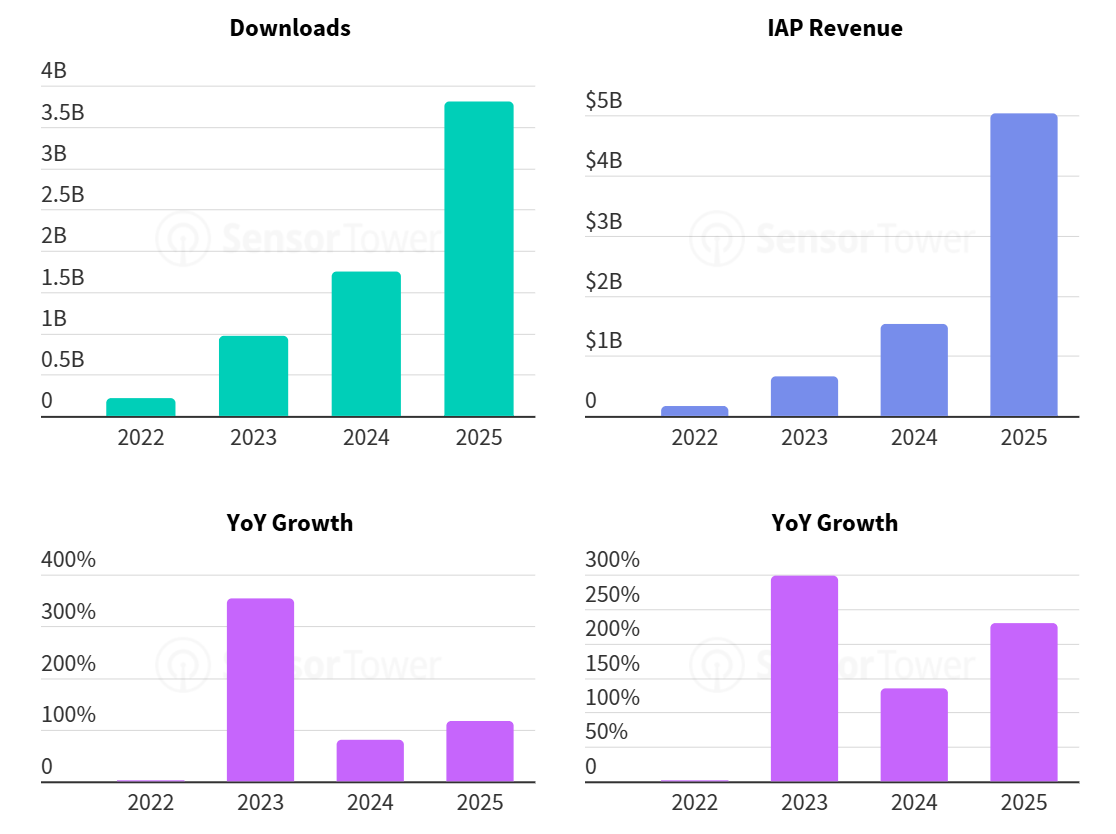

Within non-gaming apps, generative AI stood out. Image and video generation features have become key drivers of growth, significantly accelerating industry development. Generative AI app downloads doubled year-on-year, reaching 3.8 billion, and IAP revenue nearly tripled to over $5 billion, reflecting a leap forward compared to its 2022 inception.

This growth trend signals a new stage in AI competition. Tech giants such as Google (Gemini), Microsoft (Copilot), and X (Grok) have ramped up their investment in AI assistant products, expanding use cases, and releasing new features, all vying to challenge the market leader, ChatGPT.

Generative AI App Annual Trends

Generative AI App Annual Trends

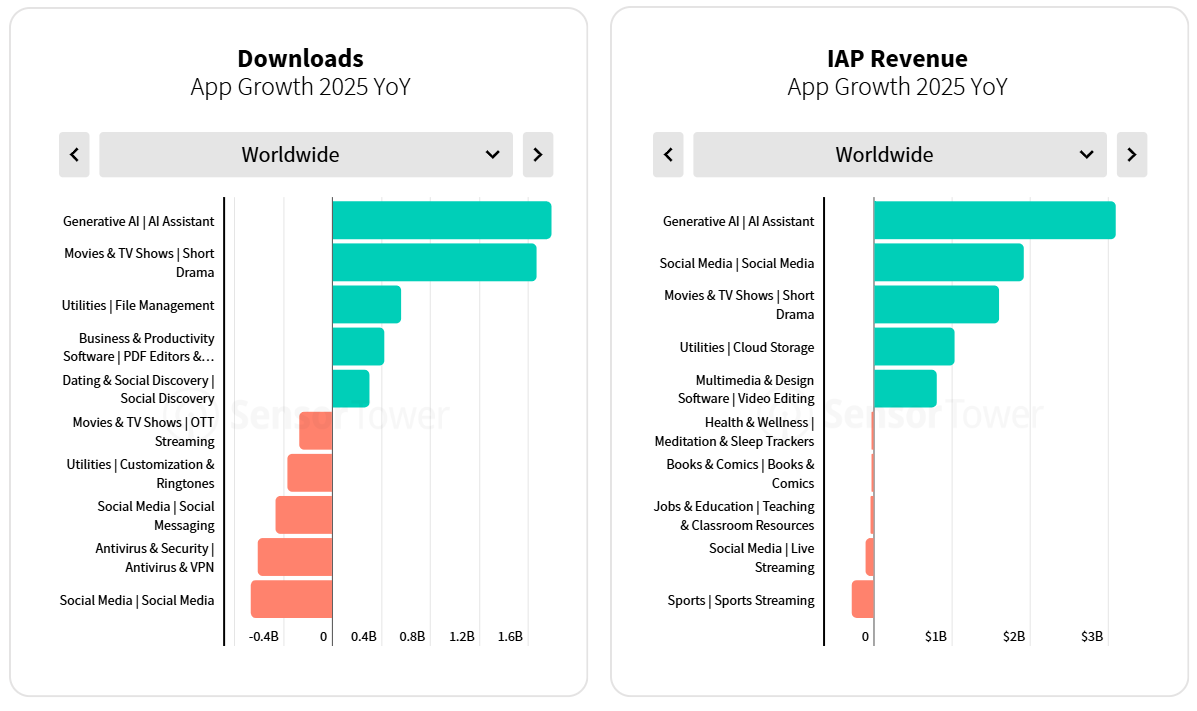

AI assistants have become the most popular category within generative AI, leading the download and IAP growth rankings for 2025.

2025 App Download and IAP Growth Rankings

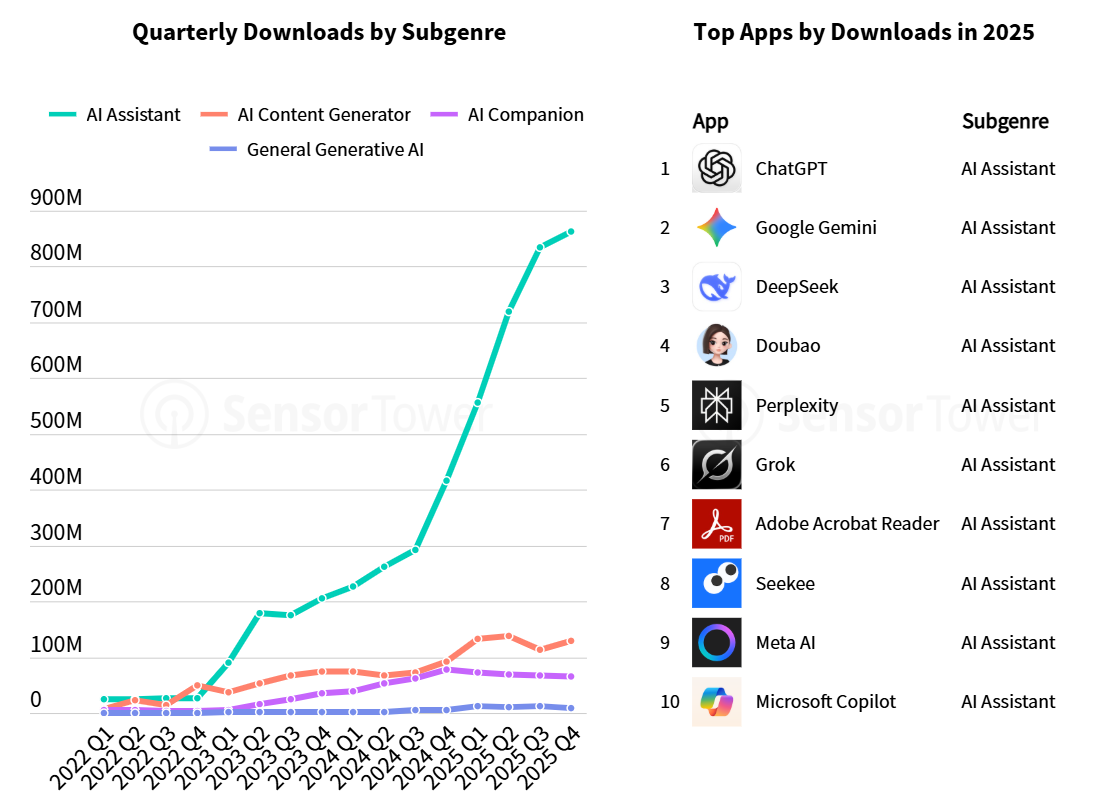

In terms of downloads, the top ten global AI apps of 2025 were all AI assistant products, with ChatGPT, Google Gemini, and DeepSeek ranking in the top three. Since Q4 2022, AI assistants have led growth trends, and from Q3 2024, with the intensification of competition, the growth of downloads became exponential.

Generative AI Subcategory Download Trends

Other AI categories have also shown growth potential. AI content generators (such as Suno, ByteDance's Dreamina AI) performed well in 2025, while AI social companion apps (like Character AI and PolyBuzz) exhibited slower growth but still maintained impressive download numbers.

Mobile Games: SLG Driving Growth

Although non-gaming app revenue surpassed gaming, mobile games remain a key pillar of the market.

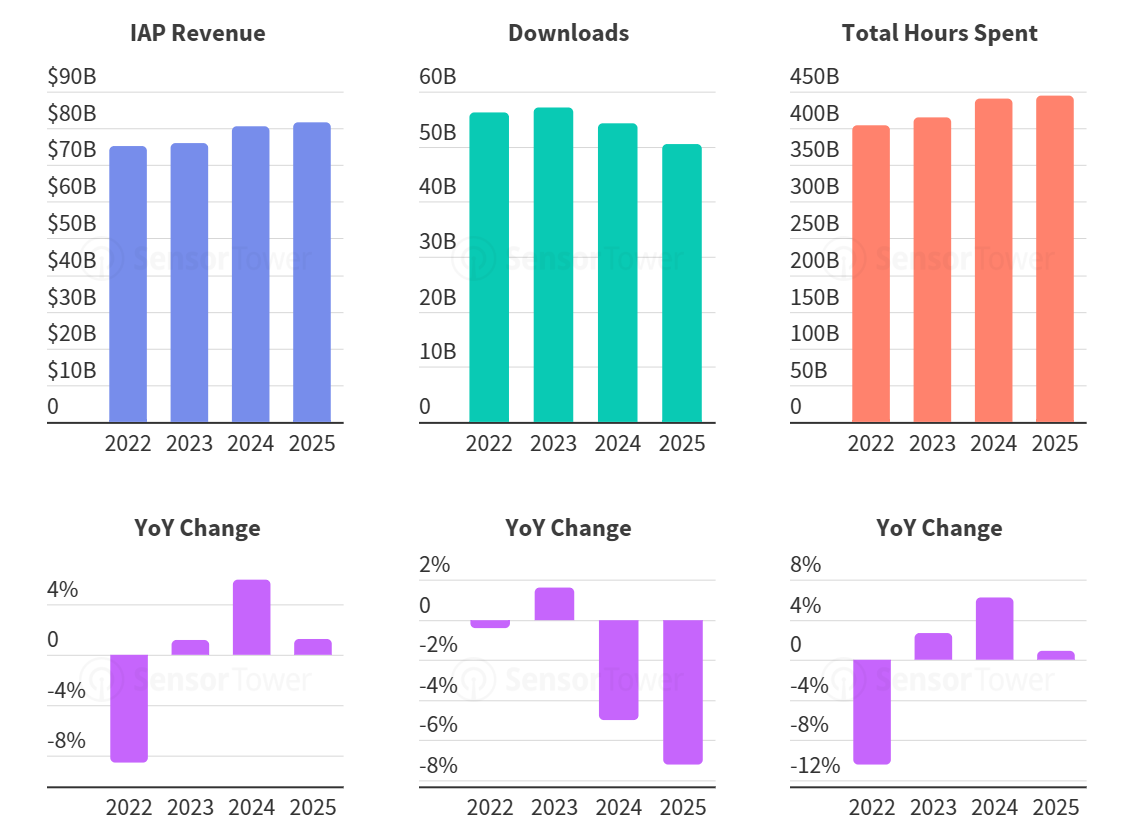

In 2025, mobile game IAP revenue on the App Store and Google Play grew by 1.3% yoy, marking three consecutive years of growth. However, downloads decreased by 7.2%, reflecting the shift in the global mobile game market from expansive growth to refined operations.

Regionally, IAP revenue growth was primarily seen in Europe, while the U.S. market remained stable. Several Asian markets shared similar trends: in mainland China, mobile game downloads dropped significantly by 18.4% year-on-year, from 920 million in 2024 to 750 million in 2025. Meanwhile, IAP revenue in these markets remained stable or showed growth. This "quantity reduction, quality improvement" trend suggests that Asia is leading the shift toward a new phase of growth, focused on user value enhancement.

In this context, growth is no longer driven solely by user acquisition but is increasingly focused on maximizing the lifetime value of existing users. Industry strategies are shifting towards improving user retention, enhancing paid user management, and focusing on precise customer acquisition based on return cycles and conversion rates.

Mobile Game Annual Trends

Mobile Game Annual Trends

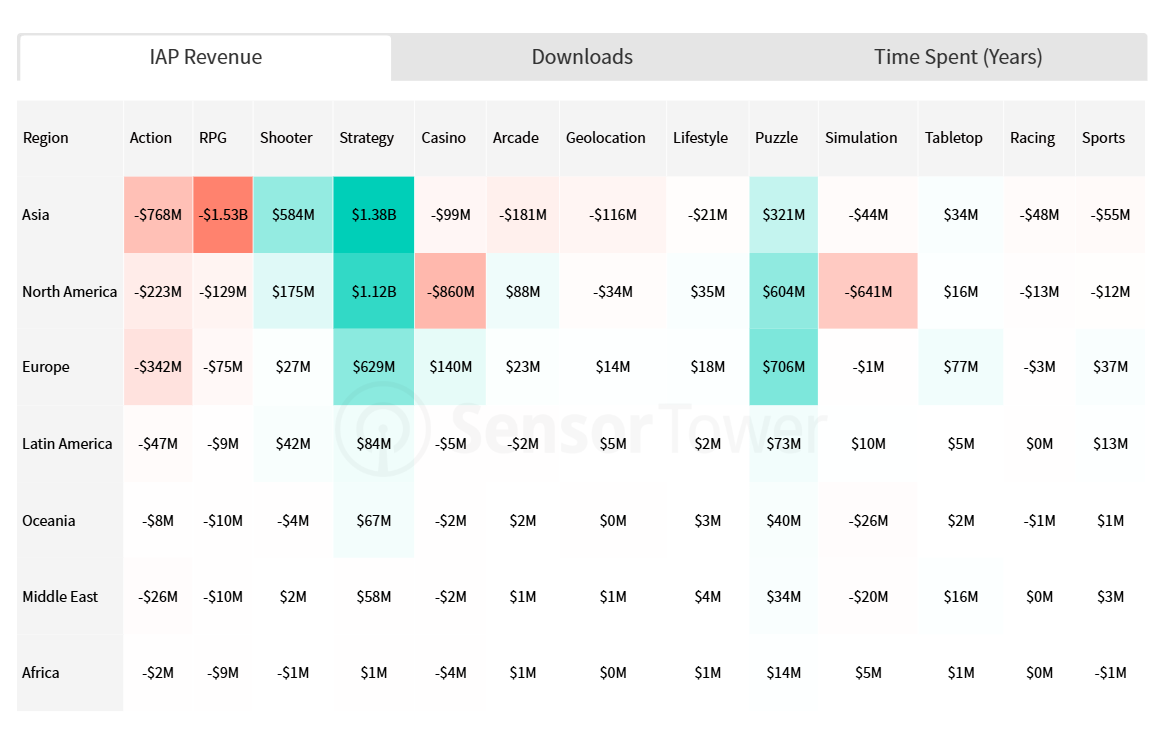

From a category and regional perspective, casual and mid-core games remain the main contributors to IAP revenue. Among them, strategy games have become the core driver of revenue growth in several regions, primarily fueled by the explosive rise of Eastern publishers in the 4X strategy genre, with titles like Last War: Survival and Whiteout Survival leading the way. Puzzle games have performed steadily in Europe, with Royal Match staying at the top and Gossip Harbor making significant contributions. Meanwhile, shooting games have shown strong performance in the Asian market, driven by new releases such as Delta Force.

YoY Changes in Mobile Game Categories and Regions for 2025

YoY Changes in Mobile Game Categories and Regions for 2025

Notably, strategy games are the only genre in 2025 to experience download growth across all three major regions — Asia, North America, and Europe — demonstrating strong growth potential. In contrast, most other genres saw a decline in downloads across key regions, with lifestyle, simulation, and puzzle games experiencing more significant drops.

Future Outlook: AI and Value Cultivation

Overall, 2025 marks the beginning of a new phase in the mobile market, driven by "structural optimization." Non-gaming apps have surpassed games in revenue thanks to broader demand connections and stronger service attributes. Generative AI has accelerated from a technological concept to a mature sector with a clear business model and strong user engagement.

Looking ahead, the industry will evolve along two main lines: first, AI will transition from an independent "feature" to a foundational "ecosystem," with its core growth shifting from tool-based applications to deep integration with existing scenarios like social, content, and e-commerce, driving experience innovation and efficiency improvements. Second, "value cultivation" has become a shared challenge across the industry. With user growth nearing its peak, both gaming and non-gaming apps must shift their focus from acquiring new users to refining their existing user base. This involves more precise user operations, more flexible business models, and sustained content services, creating healthy user value lifecycles.

It is clear that the future competition in the mobile market will no longer be about scaling but about building ecosystems, managing user value, and integrating technology. Companies that can seamlessly integrate AI capabilities with business scenarios and establish sustainable user value systems will gain a competitive edge in the next phase of the market.