July Global AI App Market Insights: “AI Chat Assistants” Dominate, Hailuo AI Downloads Surge

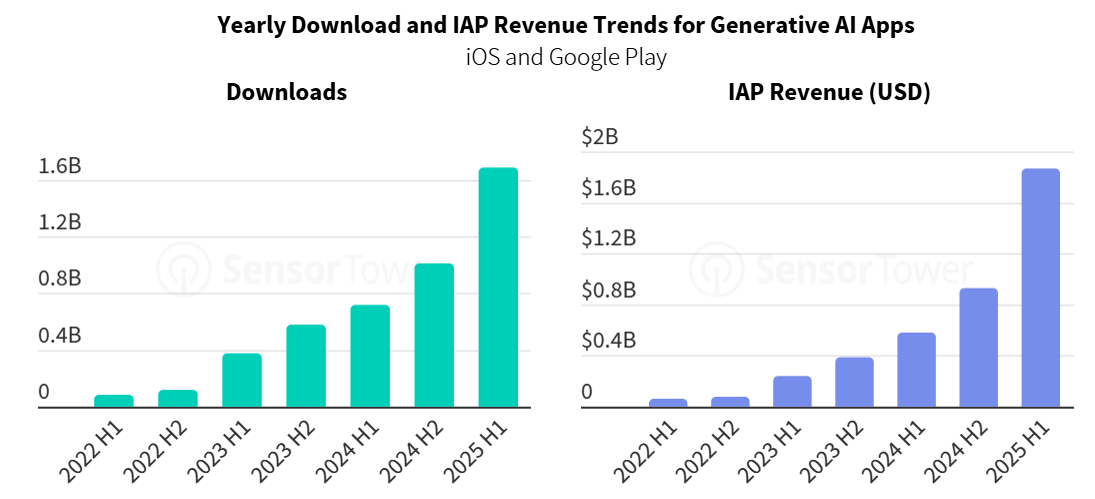

In the first half of 2025, the global AI app market maintained robust growth. According to Sensor Tower, interest in AI has soared since the launch of ChatGPT over two years ago. In H1 2025, global downloads of generative AI apps rose 67% year-over-year to nearly 1.7 billion, while in-app purchase (IAP) revenue climbed to almost $1.9 billion.

In July, the market was characterized by overall stability with pockets of notable change. This report analyzes the month’s dynamics from three perspectives: download and revenue rankings, advertising trends, and standout product cases.

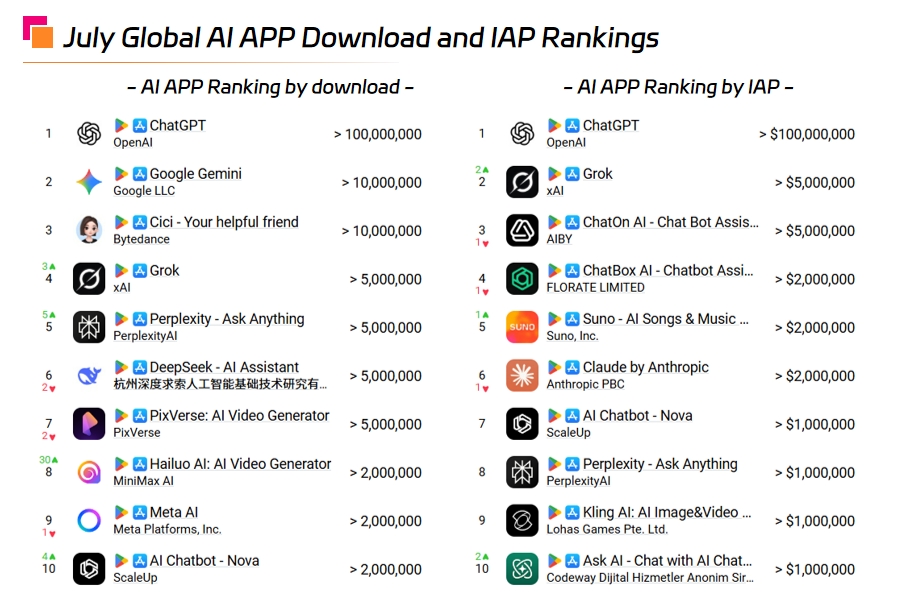

1. Downloads & Revenue Rankings

ChatGPT unsurprisingly retained its lead in both downloads and revenue. Alongside it, AI chatbots such as Gemini, Cici, Grok, Perplexity, and DeepSeek dominated, with eight of the top ten apps belonging to this category.

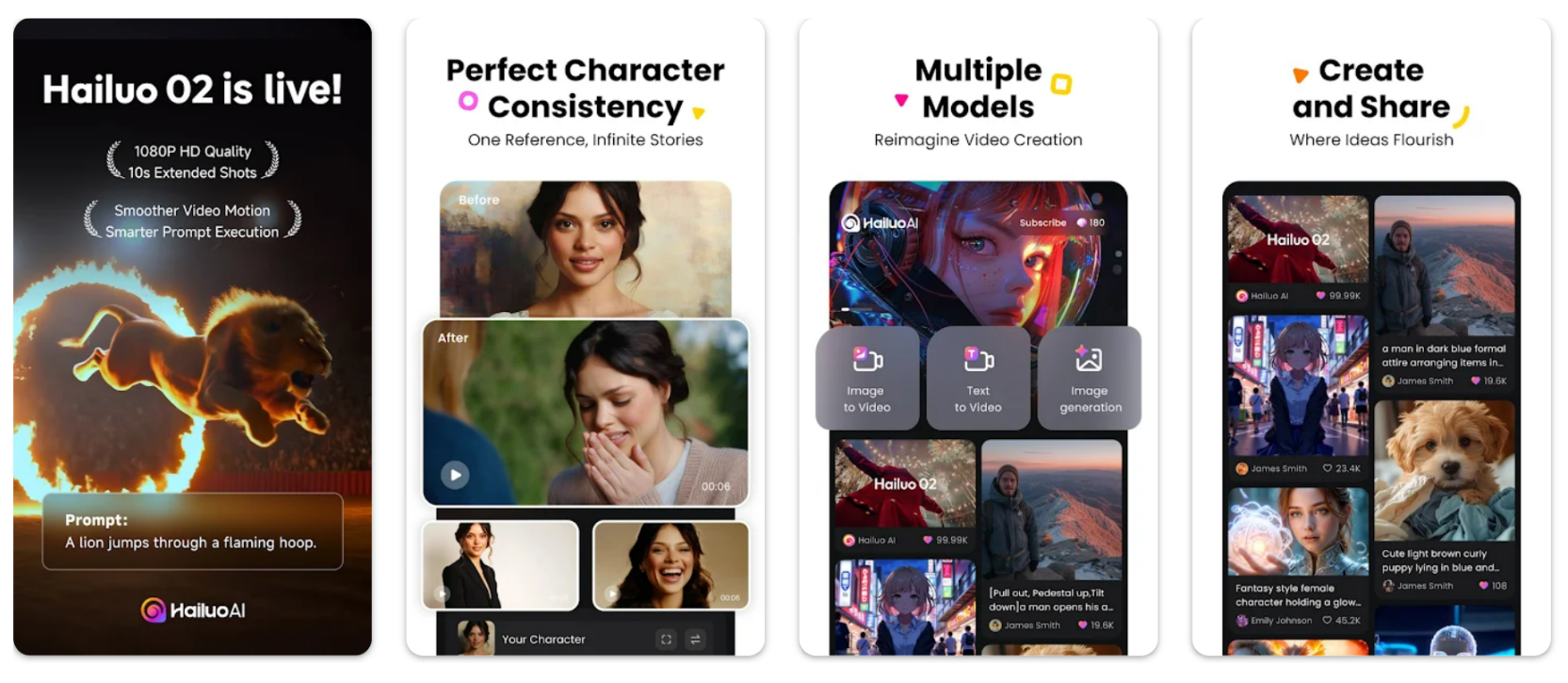

A key highlight was China’s AI video generation app Hailuo AI, which saw over 2 million downloads in July, jumping 30 places to rank 8th. Other Chinese entries in the top ten downloads included Cici (Doubao’s overseas version), DeepSeek, and Pixverse Technology’s PixVerse.

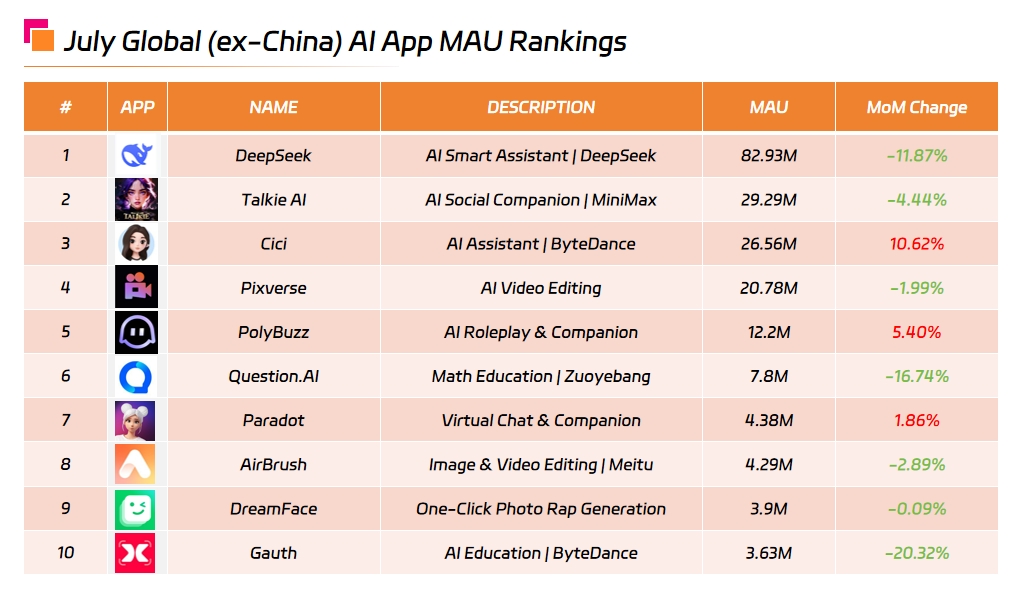

Monthly active user (MAU) rankings for Chinese AI apps showed some shifts. DeepSeek stayed at No. 1 despite an 11.87% month-over-month drop, followed by Talkie AI (–4.44%). Cici and PolyBuzz posted strong gains of 10.62% and 5.4%, respectively.

Chinese AI exports also reflected growing product diversity:

Smart Assistants (DeepSeek, Cici) focus on deep search and personalized services, maintaining stable engagement despite minor declines.

Social Companions (Talkie AI, PolyBuzz) attract users through emotional interaction and roleplay, showing steady growth.

AI Video Editors (PixVerse, AirBrush) remained on the charts but saw declines, reflecting intense competition.

Education AI (Question.AI) recorded the largest drop (–16.74%).

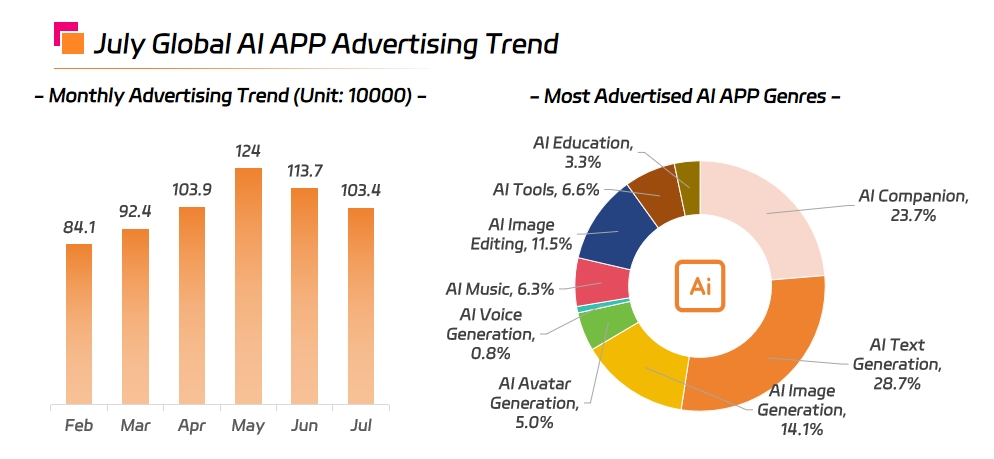

2. Advertising Trends

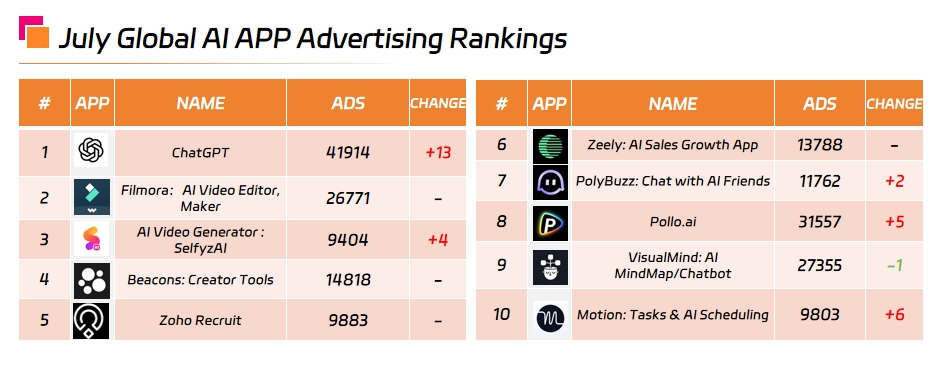

Global AI app ad creatives peaked in May 2024, then cooled to 1.034 million in July (–9.0% MoM). AI text generation, AI companion, and AI image generation were the most promoted categories, with shares of 28.7%, 23.7%, and 14.1%, respectively—highlighting demand for efficient content creation and personalized interaction.

ChatGPT was the most advertised app in July, jumping 13 spots from the previous month. Wondershare’s Filmora (overseas version of 万兴喵影) ranked second, while Wondershare’s SelfzAI (AI video generation) ranked third. Overall, top-promoted apps spanned multiple types, including image/video editors (Filmora, SelfzAI, Pollo.ai) and productivity tools (VisualMind, Motion).

3. Popular Categories & Product Highlights

Despite the dominance of AI chat assistants like ChatGPT, July saw notable growth in AI image/video editing, productivity tools, and AI companions.

AI Image & Video Editing: Continued global momentum, driven by short-form content creators. MiniMax’s Hailuo AI gained traction with an intuitive UI, high-quality outputs, and multi-scenario support. Its new video model “Hailuo 02,” launched mid-June, went viral with the “animal diving” trend, fueling a major download surge.

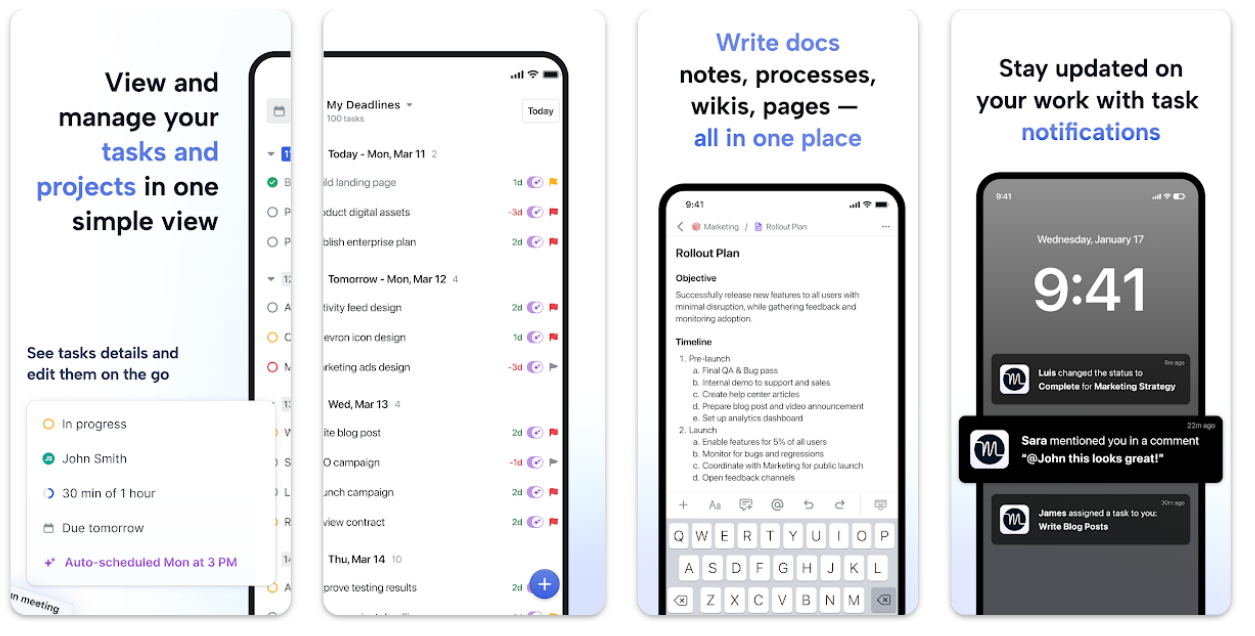

AI Productivity Tools: VisualMind offers AI-generated mind maps and structured plans for education, project management, and product design. Motion focuses on smart scheduling with algorithmic task optimization. Both target high-frequency, scenario-based use, driving retention in both B2B and B2C markets.

AI Companions & Social Interaction: Talkie AI retained its lead in roleplay and multilingual emotional interaction, while PolyBuzz differentiated through virtual character creation and real-time dialogue. These successes show that emotional engagement and immersive experiences are key drivers of retention and monetization.