Japan's Mobile App Marketing Analysis: Entertainment and Finance Apps Surge, Gaming Still Dominates Ad Spend

In 2025, Japan's mobile app market continues to rank among the world's leaders, showing strong momentum and significant industry shifts. Consumer app spending in Japan reached $16.5 billion in 2024, securing the country the third-largest market globally. While games have long been the primary driver, recent years have seen accelerating growth in finance, entertainment, and manga apps, reflecting both changing user consumption habits and new opportunities created by technological innovation.

So, what new dynamics are shaping Japan's mobile app ecosystem in 2025? How are advertisers adapting their strategies and creative formats? And which categories are driving the next wave of growth? Let's take a closer look.

1. Market Overview

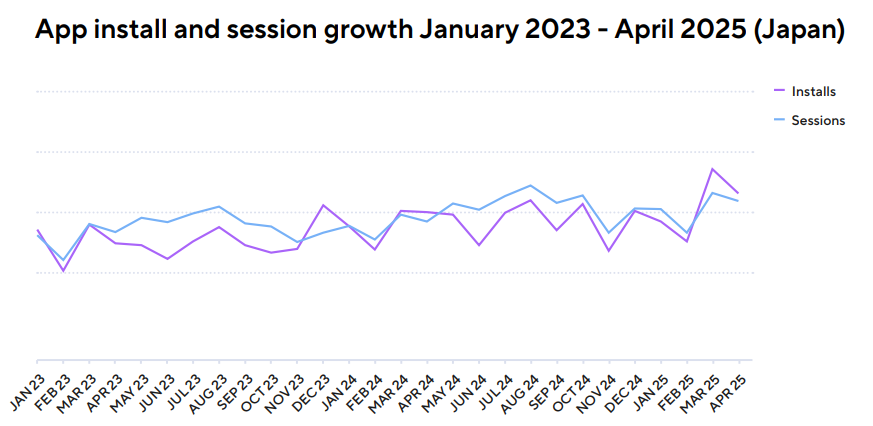

Japan remains one of the world's most valuable app markets. In 2024, total app installs grew 7% year-over-year, while app sessions rose 6%. This upward trend continued into 2025, with installs in March and April exceeding the first-half monthly average by 8% and 6%, respectively, and sessions up 2–3%.

2023–2025 Japan App Install & Session Trends (Source: Adjust)

Gaming

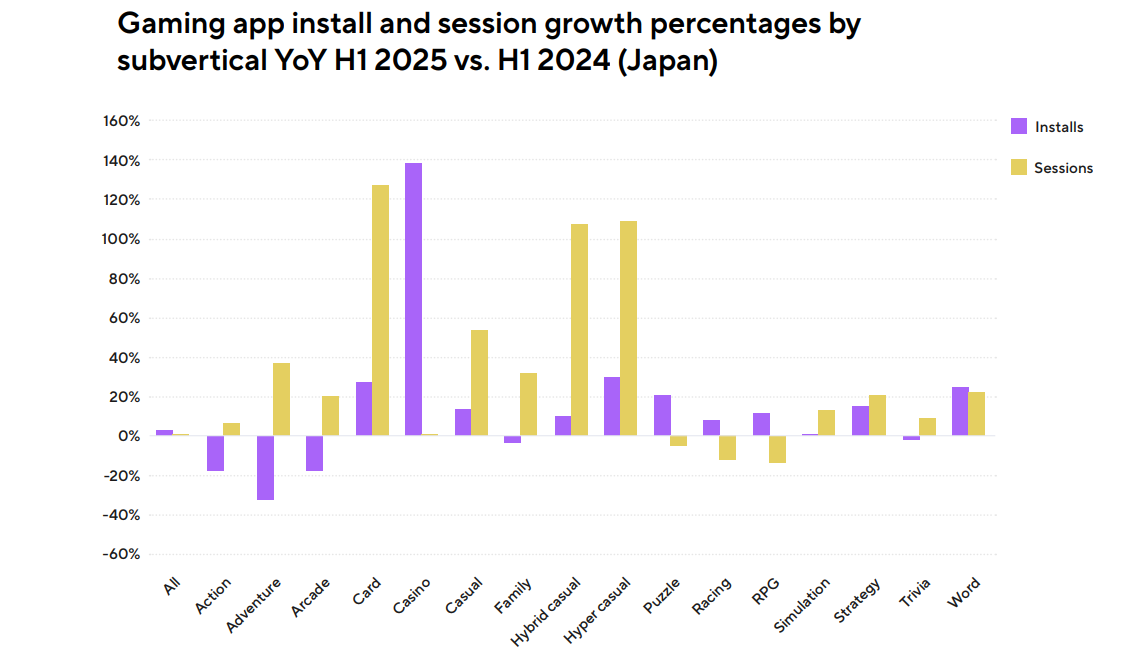

Despite global headwinds, Japan's mobile gaming sector posted 3% growth in installs in 2024, with stable session activity. Sub-genres showed diverging results:

· Card games: installs +27%, sessions +127%

· Casino games: installs +138%, sessions +36%

· Hyper-casual: installs +30%, sessions +109%

H1 2025 vs. H1 2024 Growth Rates of Game Installs & Sessions by Genre (Source: Adjust)

Entertainment

Short-drama apps are booming. Delivering bite-sized 1–2 minute series, they are especially popular among female users aged 25–44. Between August 2023 and June 2024, Japanese users spent $13.22M on these apps, accounting for 5.13% of global revenue, far outpacing their global download share. This highlights both a high product–market fit and strong consumer willingness to pay for premium short-form content.

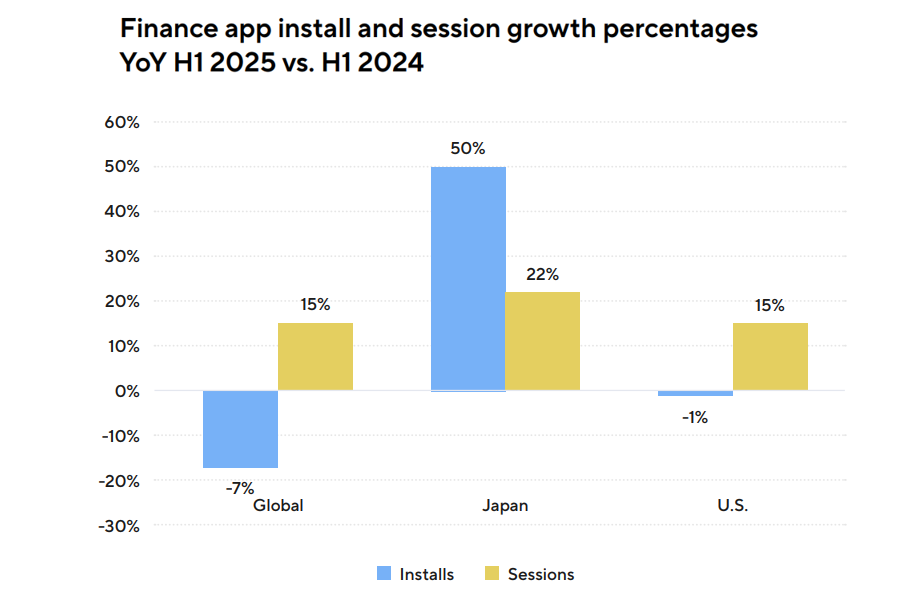

Finance

Finance apps are seeing rapid expansion. In 2024, installs grew 11% and sessions 23% year-over-year. By 2025, growth accelerated further, with installs up 50% and sessions 22%, both exceeding U.S. and global benchmarks. Payment apps dominate, led by Rakuten Pay and PayPay, which together captured 64% of installs and 72% of sessions.

2023–2025 Japan App Install & Session Trends, Adjust

Manga

Japan remains a global powerhouse for manga apps such as Piccoma and LINE Manga. While installs dipped 17% in 2024, session duration continued to climb, averaging 17.6 minutes per session—showing deep engagement despite slowing user growth.

2. Advertising Trends

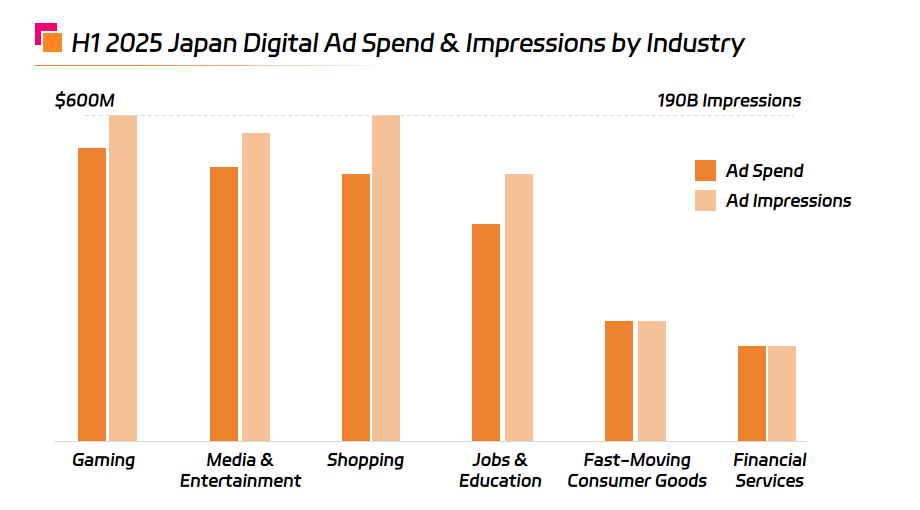

Japan's digital ad spend reached $3.5 billion in H1 2025, generating 1.3 trillion impressions. Spend was concentrated in gaming, media & entertainment, shopping, and education/employment, accounting for nearly 55% of the market.

H1 2025 Japan Digital Ad Spend & Impressions by Industry, Sensor Tower

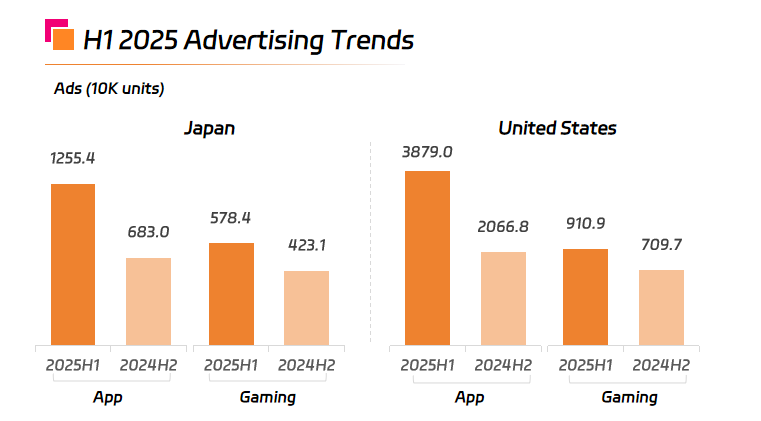

Ad activity surged across both gaming and non-gaming apps:

· Non-gaming ads: 12.55M creatives, up 174.9% YoY (outpacing the U.S. at 165.6%)

· Gaming ads: 5.78M creatives, up 60.1% YoY (also ahead of the U.S. at 39.3%)

H1 2025 Advertising Trends, Sensor Tower

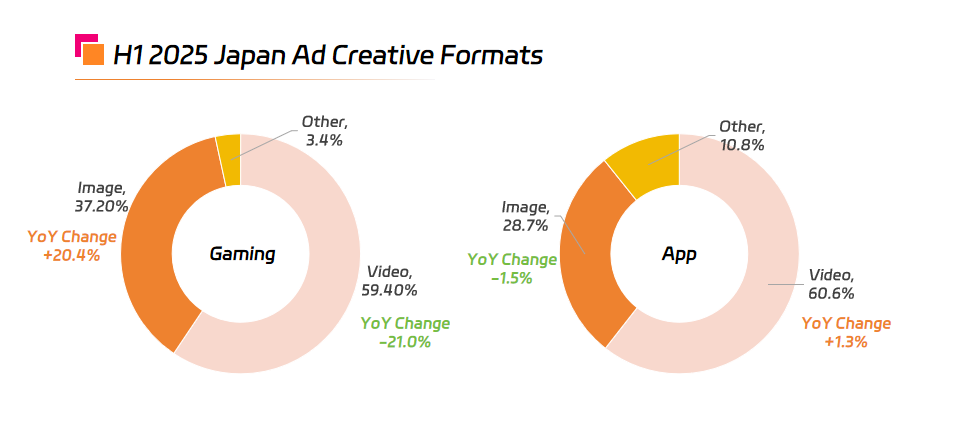

Creative Shifts

· Gaming ads: reliance on video fell from 80.4% (H1 2024) to 59.4%, while image-based creatives jumped from 16.8% to 37.2%—signaling a pivot toward stronger visual impact.

· Non-gaming ads: video use rose slightly from 59.2% to 60.6%, while image usage dipped from 30.2% to 28.7%.

Data Source: AppGrowing

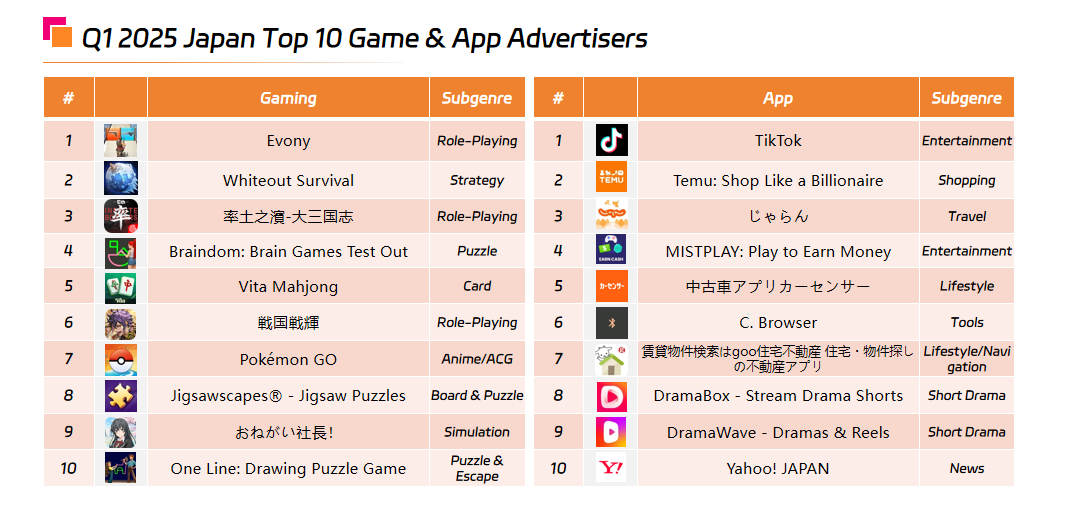

Top Advertisers (Q1 2025)

Games: RPGs dominated, with Evony, Rise of Kingdoms (率土之滨-大三国志), and Sengoku Senki (戦国戦輝) leading the charts. Strategy titles like Whiteout Survival and puzzle games like Braindom also performed strongly.

Apps: Entertainment apps TikTok and MISTPLAY topped the rankings, followed by shopping app Temu and travel app Jalan (じゃらん). Lifestyle and utility apps such as Car Sensor (カーセンサー) and C. Browser saw steady gains. Short-drama apps DramaBox and DramaWave also entered the top 10.

Data Source: AppGrowing

3. Conclusion

Japan's mobile app market in 2025 is diverse, segmented, and fast-evolving. While gaming remains a cornerstone, finance, entertainment, and manga apps are reshaping the competitive landscape. Shifts in ad creative strategies underscore advertisers' efforts to reach increasingly segmented audiences with precision.

Backed by advancing technology and evolving user behaviors, Japan will remain a global leader in mobile innovation and growth, offering brands and advertisers fertile ground for expansion in the years ahead.