Unlocking a $10B Digital Goldmine: Inside India's Explosive Growth in Gaming & Interactive Media

India is rapidly emerging as the most dynamic new force on the global digital entertainment map.

What is propelling a country with 800+ million internet users and an average age of just 29 into one of the world's hottest growth engines for gaming and interactive media—within only a few years? And why are investors, developers, and brands unanimously identifying India as the “next decade's innovation hub for digital content”?

Drawing on insights from the BITKRAFT & Redseer India Interactive Media and Gaming Report 2025, this article analyzes India's digital entertainment boom across four dimensions: the digital ecosystem, gaming industry transformation, the rise of interactive media, and future trends.

1. The Explosive Rise of India's Digital Entertainment Market

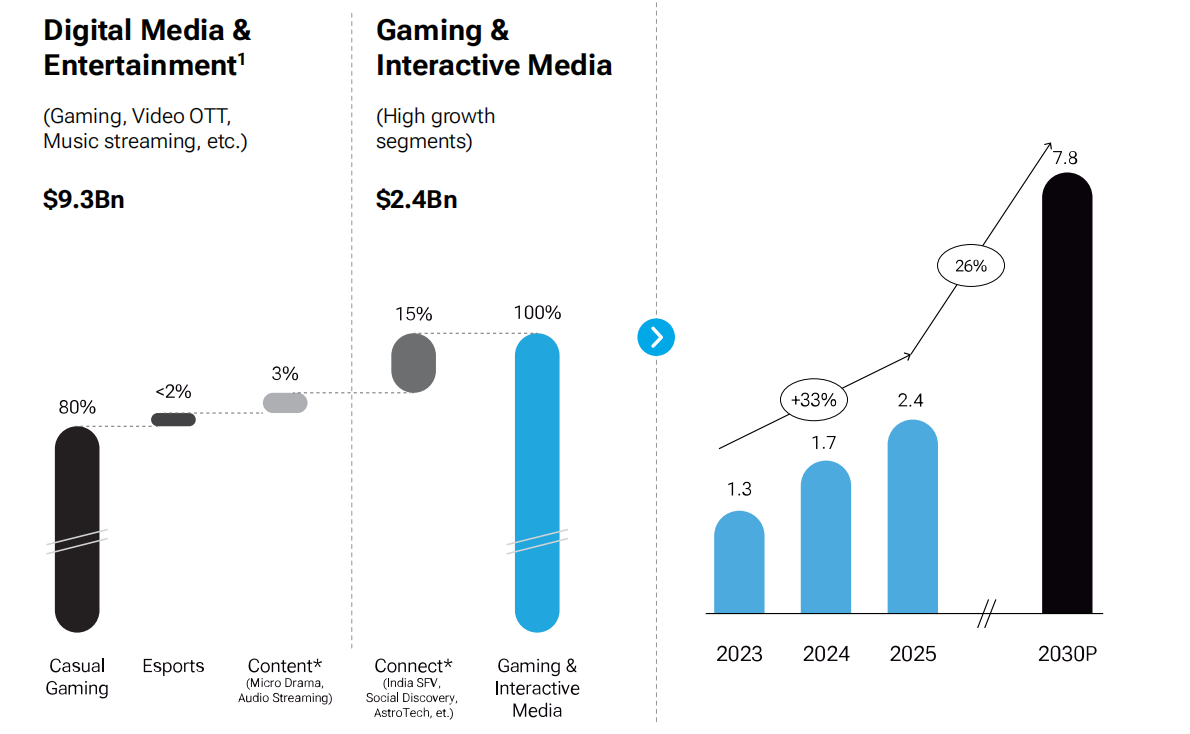

Over the past five years, India's digital entertainment industry has entered an unprecedented period of expansion. According to Redseer and BITKRAFT, India's Media & Entertainment (M&E) market reached $9.3 billion in FY2025, with gaming and interactive media accounting for 26% ($2.4 billion). This segment is expected to grow to $7.8 billion by 2030, with a 26% CAGR. This signals India's ongoing transformation from a “low ARPU, light entertainment” market into a “high-engagement, high-monetization” interactive ecosystem.

The drivers behind this surge come from both macro and micro forces.

At the macro level, India's economy continues to grow steadily. Private Final Consumption Expenditure (PFCE) accounts for over 60% of GDP, and household spending on leisure and entertainment is steadily increasing.

At the micro level, India's internet infrastructure and mobile ecosystem have matured significantly: the country has 835 million internet users, a median age of 29, and an average daily smartphone usage of more than 5 hours. Mobile user growth in Tier-2 and Tier-3 cities is particularly notable. With digital payment tools such as UPI becoming universal, barriers to paid content are rapidly falling—making digital entertainment a truly accessible category for all.

2. Gaming Industry: From Regulatory Transition to Innovation-Driven Growth

The turning point for India's gaming industry came in 2025. The introduction of the Online Gaming Act formally ended the long-standing chaos surrounding Real Money Gaming (RMG) and redirected the industry toward healthier and more sustainable growth in digital gaming and esports. This regulatory shift laid a solid institutional foundation for long-term development and restored confidence among global investors and brand partners.

Currently, India's gaming market is valued at $2.4 billion, and is expected to exceed $4.3 billion by 2030. Mobile remains the dominant platform, accounting for more than 80% of the user base. Importantly, the structure of both game content and audiences is shifting:

- Female players now represent 25% of the user base, with Gen Z and millennials driving most of the spending;

Users favor interaction-driven experiences centered on social features, storytelling, and strategy;

Simulation, casual competitive titles, and hybrid-casual games are among the fastest-growing categories.

India’s ARPPU has increased ninefold in five years — Source: Redseer

Local development capabilities are also rising rapidly. India has produced over 500 gaming startups in just five years, focusing on AI-powered development, art outsourcing, tool engines, and localized content. AI is now deeply integrated across the gaming production pipeline—from level generation and narrative writing to character voices—significantly improving efficiency and lowering barriers for smaller teams. In terms of content themes, “Indian narrative” has become a new creative direction. Titles inspired by mythology, religion, and cultural life reinforce cultural resonance among domestic players.

In esports, India is transitioning “from passion to industry.” The esports market currently stands at $40 million, supported mainly by mobile esports titles such as BGMI and Free Fire. Organizations like Nodwin and Skyesports are building a mature ecosystem, while brand sponsorships are accelerating commercialization. For Indian youth, esports is increasingly seen as both a social identity and a career opportunity, gradually gaining cultural status comparable to cricket.

Overall, India's gaming industry is moving from regulatory uncertainty toward a new era defined by innovation, localization, and AI empowerment. For global developers and advertisers, this represents a market with long-term potential, cultural depth, and commercial clarity.

3. The Rise of Interactive Media

If gaming is India's “growth engine,” then interactive media is its new “monetization engine.” In FY2025, India's interactive media market reached $440 million, and is expected to grow nearly sevenfold to $3.2 billion by 2030. This sector spans short dramas, audio storytelling, devotional and astrology tech, and other fast-growing categories. What ties them together is a shared focus on local languages, mobile-native formats, and micro-payments.

Short dramas, devotional content, and astrology tech will grow rapidly — Source: Redseer

Short dramas, devotional content, and astrology tech will grow rapidly — Source: Redseer

Among them, micro dramas (short-form series) have become the fastest-growing format. Borrowing from China's model, Indian platforms such as Kuku TV and Quick TV focus on ultra-short content—typically under two minutes—with themes including romance, wealth fantasy, and suspense. Their core audience is women aged 18–35, with much higher retention and conversion rates than traditional streaming services.

Micro dramas monetize primarily through UPI auto-renewal subscriptions, typically priced around ₹499 per quarter. With AI integrated into scriptwriting, dubbing, and editing, production costs are falling quickly, creating enormous room for local content creation.

Projected short drama market expansion — Source: Redseer

Projected short drama market expansion — Source: Redseer

Meanwhile, the audio entertainment market is expanding steadily. Platforms like Pocket FM and Kuku FM have surpassed 14 million MAUs, with users listening 95 minutes per day on average. Audio content is shifting from passive entertainment to immersive storytelling, with romance, mythology, and personal growth as dominant genres—80% in regional languages. AI-powered personalization and synthetic voice production are elevating content production efficiency.

Another fast-rising category is Devotional & Astrology Tech, which digitizes traditional spiritual practices, enabling users to access astrology readings, prayer services, or even virtual religious livestreams. Thanks to India's large religious population and global diaspora, this market reached $165 million in 2025, and is projected to surpass $1.3 billion by 2030. Beyond cultural tradition, this reflects a growing demand for emotional comfort and cultural identity through digital platforms.

The rise of interactive media signals a broader shift: India's entertainment consumption is moving from passive viewing to active participation. Content is no longer merely consumed—it becomes an emotional anchor and a form of identity expression. For brands, this opens new possibilities in advertising, creator partnerships, and immersive content marketing.

4. Trends Outlook & Conclusion

India is evolving from a “content consumption nation” to a creator nation. Over the next five years, several major trends will shape this transformation:

AI and content production will deeply converge. From game worldbuilding to short drama scriptwriting, AI will dramatically boost production efficiency, empowering small teams to compete with major studios.

Regional languages and cultural narratives will dominate. To win user mindshare, brands and developers must prioritize cultural resonance and local storytelling.

Women and the new middle class will reshape consumer behavior. Demand for romance, relationship, and emotional content will continue to expand.

Cross-ecosystem convergence will accelerate. Boundaries between games, short dramas, audio platforms, and social media will blur, forming a unified ecosystem of content + interaction + payments.

For global developers, advertisers, and investors, India is no longer just a “traffic market.” It is a strategic market with scale, innovation momentum, and deep cultural roots.

As mobile infrastructure strengthens and content ecosystems merge, India is poised to become the next global center for digital entertainment and interactive media innovation—following China's rise, but evolving along its own cultural and technological trajectory.